1. What Are The Types Of Derivatives?

A derivative is a contract between two or more parties who can trade over the counter or on an exchange (OTC). These contracts can be used to trade a variety of assets, but they come with their own set of dangers. Derivative prices are determined by movements in the underlying asset. These financial instruments are often used to get access to specific markets and can be exchanged to mitigate risk.

Types Of Derivatives

- Forwards

- A forward contract is a customized contract between two parties, where settlement takes place on a specific date in future at a price agreed today. The main features of forward contracts are.

- They are bilateral contracts and hence exposed to counter-party risk.

- Each contract is custom-designed designed, hence is unique in terms of contract size, expiration date asset type and quality.

- The contract price is generally not available in the public domain.

- The contract has to be settled by delivery of the asset on the expiration date.

- In case the party wishes to reverse the contract, it has to compulsorily go to the same counterparty, which being in a monopoly situation can command the price it wants.

- Futures

- The futures contract is traded on a futures exchange as a standardized contract, subject to the rules and regulations of the exchange. It is the standardization of the futures contract that facilitates secondary market trading.

- The futures contract relates to a given quantity of the underlying asset and only whole contracts can be traded, and trading of fractional contracts is not allowed in futures contracting.

- The terms of the futures contracts are not negotiable. A futures contract is a financial security, issued by an organized exchange to buy or sell a commodity, security or currency at a predetermined future date at a price agreed upon today. The agreed-upon price is called the “futures price”.

The Important Features Of Futures Contract Are Given Below

- Standardization

The important feature of futures contracts is the standardization of contracts. Each futures contract is for a standard specified quantity, grade, coupon rate, maturity, etc. The standardization of contracts fetches the potential buyers and sellers and increases the marketability and liquidity of the contracts.

- Clearinghouse

An organization called ‘futures exchange’ will act as a clearinghouse. In a futures contract, the obligation of the buyer and the seller is not to each other but to the clearing house in fulfilling the contract, which ensures the elimination of the default risk on any transaction.

- Time Spreads

There is a relationship between the spot price and the futures price of the Notes contract. The relationship also exists between prices of futures contracts, which are on the same commodity or instrument but which have different expiry dates. The difference between the prices of two contracts is known as the ‘time spread’, which is the basis of the futures market.

- Margins

Since the clearing house undertakes the default risk, to protect itself from this risk, the clearing house requires the participants to keep margin money, normally ranging from 5% to 10% of the face value of the contract.

- Exchange-based trading

Trading takes place on a formal exchange which provides a place to engage in these transactions and sets a mechanism for the parties to trade these contracts.

- No default risk

Future contracts have no default risk because the exchange acts as a counterparty and guarantees delivery and payment with the help of clearing houses

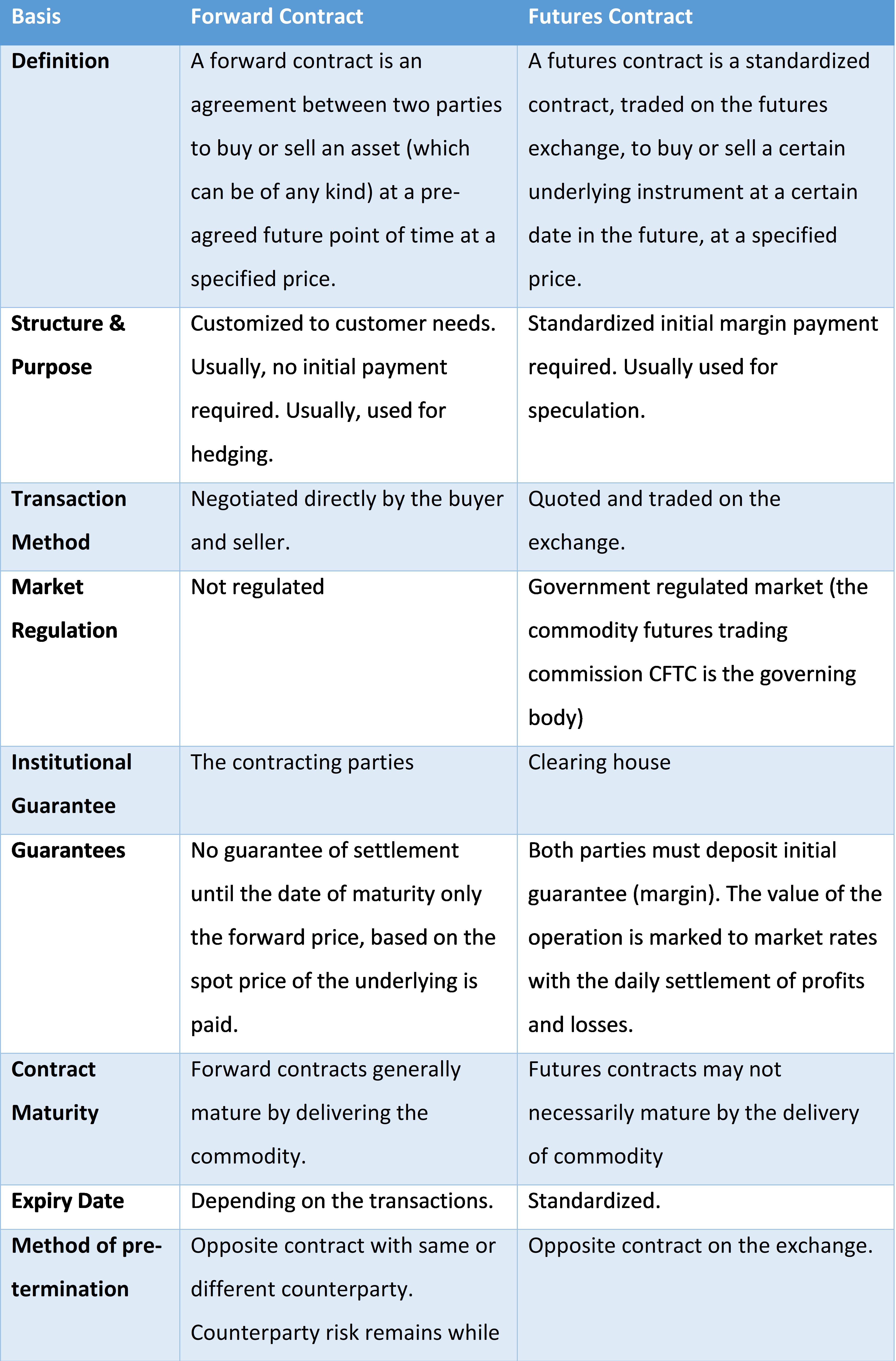

Comparison Between Forward & Futures Contract

Swaps

A swap is a financial instrument arrangement in which two parties swap cash flows or liabilities from two separate financial instruments. Although the instrument can be nearly anything, most swaps involve cash flows based on a notional principal sum, such as a loan or bond. The principal does not usually change hands. The swap is made up of one leg for each cash flow.

Swaps are not exchange-oriented and are traded over the counter, usually, the dealing is oriented through banks. Swaps can be used to hedge risk of various kinds which includes interest rate risk and currency risk.

- The two commonly used swaps are interest rate swaps and currency swaps: –

- Interest rate swaps

These involve swapping only the interest-related cash flows between the parties in the same currency

- Currency swaps

This entails swapping both principal and interest between the parties, with the cash flows in one direction being in a different currency than those in the opposite direction

-

- Options

Option may be defined as a contract, between two parties whereby one party obtains the right, but not the obligation, to buy or sell a particular asset, at a specified price, on or before a specified date. The person who acquires the right is known as the option buyer or option holder, while the other person (who confers the right) is known as the option seller or option writer. The seller of the option for giving such an option to the buyer charges an amount which is known as the option premium.

Options can be divided into two types: calls and puts. A call option gives the holder the right to buy an asset at a specified date for a specified price whereas in a put option, the holder gets the right to sell an asset at the specified price and time. The specified price in such a contract is known as the exercise price or the strike price and the date in the contract is known as the expiration date the exercise date or the maturity date.

The asset security instrument or commodity covered under the contract is called as the underlying asset. They include shares, stocks, stock indices, foreign currencies, bonds, commodities, futures contracts, etc. Further options can be American or European. A European option can be exercised on the expiration date only whereas an American option can be exercised at any time before the maturity date.

-

- Example

Suppose the current price of CIPLA shares is Rs.750 per share. X owns 1000 shares of CIPLA Ltd. and apprehends the decline in the price of the share. The option (put) contract available at BSE is Rs. 800, for the next two-month delivery. The premium cost is Rs.10 per share. X will buy a put option at 10 per share at a strike price of Rs. 800. In this way X has hedged his risk of price fall of stock. X will exercise the put option if the price of the stock goes down below Rs. 790 and will not exercise the option if the price is more than Rs. 800, on the exercise date. In the case of options, the buyer has a limited loss and unlimited profit potential unlike in the case of forward and futures.

It should be emphasized that the option contract gives the holder the right to do something. The holder may exercise his option or may not. The holder can make a reassessment of the situation and seek either the execution of the contracts or its nonexecution as being profitable to him. He is not under obligation to exercise the option. So, this fact distinguishes options from forward contracts and futures contracts, where the holder is under obligation to buy or sell the underlying asset. Recently in India, the banks have been allowed to write cross-currency options after obtaining permission from the Reserve Bank of India.

-

- Warrants & Convertibles

Warrants and convertibles are other important categories of financial derivatives, which are frequently traded in the market. A warrant is just like an option contract where the holder has the right to buy shares of a specified company at a certain price during the given period. In other words, the holder of a warrant instrument has the right to purchase a specific number of shares at a fixed price in a fixed period from an issuing company. If the holder exercised the right, it increases the number of shares of the issuing company, and thus, dilutes the equities of its shareholders. Warrants are usually issued as sweeteners attached to senior securities like bonds and debentures so that they are successful in their equity issues in terms of volume and price. Warrants can be detached and traded separately. Warrants are highly speculative and leverage instruments, so trading in them must be done cautiously

Convertibles are hybrid securities that combine the basic attributes of fixed-interest and variable-return securities. Most popular among these are convertible bonds, convertible debentures and convertible preference shares. These are also called equity derivative securities. They can be fully or partially converted into the equity shares of the issuing company at the predetermined specified terms with regards to the conversion period, conversion ratio and conversion price.

2. Participants In Derivative Market

The participants in the derivatives market can be broadly categorized into the following four groups:

Hedgers

- Hedging is when a person invests in financial markets to reduce the risk of price volatility in exchange markets, i.e., eliminate the risk of future price movements. Derivatives are the most popular instruments in the sphere of hedging. This is because derivatives are effective hedges in correspondence with their respective underlying assets.

Speculators

- It is the most common market activity that participants of a financial market take part in. It is a risky activity that investors engage in. It involves the purchase of any financial instrument or an asset that an investor speculates to become significantly valuable in the future. Speculation is driven by the motive of potentially earning lucrative profits in the future.

Arbitrageurs

- It is a very common profit-making activity in financial markets that comes into effect by taking advantage of or profiting from the price volatility of the market. Arbitrageurs make a profit from the price difference arising in an investment of a financial instrument such as bonds, stocks, derivatives, etc.

3. What Is An Option Premium?

An option premium is the price that traders pay for a put or call options contract. When you buy an option, you’re getting the right to trade its underlying market at a specified price for a set period. The price you pay for this right is called the option premium.

The size of an option’s premium is influenced by three main factors: the price of the underlying market, its level of volatility (or risk) and the option’s time to expiry.

How Option Premium Is Calculated

Option premiums are calculated by adding an option’s intrinsic value to its time value.

Premium= Intrinsic Value + Time Value

So, if a call option has an intrinsic value of Rs15 and a time value of Rs.15, you’ll need to pay Rs.30 to purchase it. To make a profit from the option, you will need to exercise it when the underlying market is more than Rs.30 over the strike price.

Option premiums and intrinsic value

- Intrinsic value is the difference between the option’s strike price and the current price of the underlying market. For call options, intrinsic value is calculated by subtracting the strike price from the underlying price. For put options, the opposite is true- intrinsic value is calculated by subtracting the underlying price from the strike price.

- Say you’re considering purchasing an option to buy ABC stock for Rs.44 when it is currently trading at Rs.50. You’d be able to exercise your option and make Rs.6, so the option’s intrinsic value is Rs.6. If ABC stock dropped below Rs.44, the option’s intrinsic value would be Rs.0.

Option premiums and time value

- Time to expiry also affects an option premium’s time value. The longer an option has before it expires, the more time the underlying market has to pass the strike price, and vice versa. Continuing our example above, say you were choosing between two call options on ABC stock with the same strike price but different expiries. You might consider paying more for the option with the longer expiry, as it gives more time for you to exercise the option at profit.

- Falling time value is known as time decay, a risk that options traders need to manage. As an option nears expiry, time decay means that its value will drop.

- Another key aspect of time value is the market’s implied volatility. A more volatile market is more likely to move beyond the strike price, which means volatile markets will often come with higher premiums.

- You can calculate an option’s time value by subtracting its intrinsic value from its premium.

- Say ABC stock’s market price is Rs.50, and you buy a call option with a strike price of Rs.44 for a Rs.200 premium. The intrinsic value will then be Rs.6 (Rs.50 – Rs.44) and the time value will be Rs.194 (Rs.200 – Rs.6).

4. What Is Meant By Commodity?

A commodity is generally considered to be any kind of tangible good that can be interchanged with other goods of the same type. According to the Securities Contracts (Regulation) Act, 1956 (SCRA) “goods” mean every kind of movable property other than actionable claims, money and securities. Commodities are mostly used as inputs in the production of other goods or services. Grains, Gold, Crude Oil, Copper, and Natural Gas are some examples of commodities.

What Is Commodity Exchange?

A commodity exchange is an exchange where various commodities, derivative products, agricultural products and other raw materials are traded.

Most of the commodity markets across the world trade in commodities such as wheat, barley, sugar, maize, cotton, cocoa, coffee, milk products, pork bellies, oil, metals, etc. Commodities exchanges usually trade futures contracts on commodities.

Major Commodity Exchanges in India

- Multi Commodity Exchange of India

- National Multi Commodity Exchange of India

- Indian Commodity Exchange

- National Commodity and Derivatives Exchange

What Are The Types Of Commodities Traded In The Commodity Derivatives Market?

The commodities traded in the Indian commodity derivative markets are usually classified into four segments. These are as follows:

Agricultural Commodities

- These are generally perishable agricultural products such as soybean, cotton, chana, maize, sugar, guar seed etc. Processed agricultural commodities like soybean oil, palm oil, guar gum etc. are also considered agricultural commodities.

Bullion and Gems

- This segment predominantly consists of precious metals like gold, and silver and precious gems like diamond.

Energy commodities

- This segment includes commodities that serve as major energy sources. These commodities are traded in both the unprocessed form in which they are extracted or in various refined forms or by-products of refining/processing. Crude oil, natural gas etc. are examples of energy commodities.

Metal commodities

- This segment includes various non-precious metals that are mined or processed from the mined metals such as copper, brass, iron, steel, etc.

What Is A Commodity Derivatives Market?

- Commodity Derivative Market is a place, where the investor can directly invest in Commodities, rather than investing in those companies that trade in these commodities.

- In other words, Commodity Derivative markets are the market, where the trade is undertaken through a future/options/swap contract. Under these contracts, as the name suggests, the transaction is completed at a future date.

- Commodity Derivatives markets are a good source of critical information and indicators of market sentiments. Since commodities are frequently used as input in the production of goods or services, uncertainty and volatility in commodity prices and raw materials make the business environment erratic, unpredictable and subject to unforeseeable risks.

What Is A Commodity Derivatives Contract?

- A derivative contract, which has a commodity as its underlying, is known as a ‘commodity derivatives’ contract. Commodity derivative means a contract:

- (i) for the delivery of such goods, as may be notified by the Central Government in the Official Gazette, and which is not a ready delivery contract; or

- (ii) for differences, which derives its value from prices or indices of prices of such underlying goods or activities, services, rights, interests and events, as may be notified by the Central Government, in consultation with the Board, but does not include securities as referred to in sub-clauses (A) and (B) in the definition of Derivatives.

Advantages Of Commodity Derivatives Market

The commodity derivatives market provides various direct and indirect benefits to commodity value chain participants. The key benefits of the Commodity derivatives market are as follows:

- Price Discovery

Provides a nationwide platform for the discovery of prices and enables physical market participants to hedge their price

- Hedging Price Risk

In the absence of Derivatives, various value chain participants like small producers and end users lose an invaluable tool for hedging their price risk, getting advance price signals of the commodity and making informed decisions on cropping, timing of sales

- Investment Opportunity

A successful derivative contract in any commodity catalyzes the development of marketing infrastructure like warehousing, and assaying facilities which in turn facilitates pledge financing through warehousing and banks

- Diversification

Commodity prices are prone to supply-demand dynamics, weather conditions, geo-political tensions and natural disasters. Accordingly, commodities are an independent asset class and can prove to be an effective means of diversification in one’s investment portfolio.

Regulatory Framework For Commodity Derivatives Market

- Who regulates the commodity derivatives market in India?

Securities and Exchange Board of India (SEBI) has been regulating the commodity derivatives market in India since September 28, 2015. Before September 28, 2015, the Commodity derivatives market was regulated by the erstwhile Forward Markets Commission (FMC).

- What is the need for regulating the commodity derivatives market?

Regulation is needed to ensure fairness and transparency in trading, clearing, settlement and management of the market institutions including stock exchanges, clearing corporations, and broking houses, and also to maintain the integrity of the marketplace, to protect and promote the interest of various stakeholders and investors.

- What is the broad regulatory framework in which the commodity derivatives market operates in India?

The regulatory framework for the commodity derivatives market comprises of Government of India, the Securities and Exchange Board of India SEBI and SEBI-recognized stock exchanges/ clearing corporations which also perform supervisory functions over their members.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.