Tax Deducted at Source (TDS) is a taxation mechanism put in place to deduct tax at the income source automatically. TDS is levied on several different incomes including salary, FD interest, dividend payouts, rental income and more. However, eligible resident Indian citizens can get relief from TDS deductions by submitting Form 15G or Form 15H with the deductor. In the below sections, we will discuss details about Form 15G and Form 15H including but not limited to what they are, the eligibility criteria, applicability of these forms and their various parts.

What are Form 15G and Form 15H?

Form 15Gis a self-declaration form that an individual taxpayer aged less than 60 years and Hindu Undivided Families (HUFs) can submit to request deductors like banks not to deduct TDS (tax deducted at source) on passive income like interest income from term deposits, rental income, etc.

Form 15H is a self-declaration form that a resident senior citizen can submit to a deductor like a bank to request non-deduction of TDS on passive income such as interest from fixed deposits, recurring deposits, rental income, etc. received during the financial year. So, as per this definition, only individuals over 60 years and Indian residents are eligible to submit this form with a deductor.

The applicable form (15G or 15H) is typically submitted along with a copy of the PAN card of the taxpayer to validate that the applicant has an annual income lower than Rs. 2.5 lakh for the applicable financial year.

Form 15G vs Form 15H: How Do They Differ?

While Form 15H is very similar to Form 15G in many ways, there are two key differences one needs to keep in mind:

- Individuals aged below 60 years are not eligible to submit Form 15H they can only submit Form 15G

- Form 15H cannot be submitted by Hindu Undivided Family (HUF), while HUF can submit Form 15G

Eligibility Criteria for Form 15G Submission

Now that you know what form 15G is, let’s see if you can use it. You may furnish form 15G for non-deduction of tax from the interest accrued if you meet the below-mentioned conditions:

- Your income for the fiscal year is less than ₹2.5 lakh.

- You are less than 60 years old and an Indian citizen.

- You have zero tax liability for the fiscal year.

- HUFs with annual income less than ₹2.5 lakh are also eligible for Form 15G submission.

Eligibility Criteria for Form 15H Submission

As discussed above, only resident senior citizens in India are eligible to submit and benefit by submission of this TDS form. The following are details of the Form 15H eligibility criteria that one needs to keep in mind:

- Senior citizens, i.e. individuals aged 60 or above are eligible to submit the form

- The Form 15H declarant must be an Indian resident

- The declarant’s annual taxable income for the fiscal must be nil

Based on the current eligibility criteria, senior citizen individuals with net taxable income of zero after rebate under Section 87A are also eligible for TDS relief using Form 15H. However, senior citizens with higher income i.e. Rs. 5 lakh or more in a fiscal cannot avail of this nefit.

WhbenefititSubmittingt Form 15G and Form 15H?

While Form 15H is mainly submitted to banks by senior citizens seeking TDS relief on term deposit interest. Similarly, Form 15G is mostly used for the same purpose by HUF and individual taxpayers aged at least five years. But, these form can be submitted to get TDS relief in some other situations too.

A few other cases where Form 15G and Form 15H can prevent TDS deduction include:

Savings on TDS on Rent: Eligible senior citizens may submit Form 15H with tenants to prevent the application of TDS on the rental income. This is because tenants are supposed to deduct TDS and deposit it with tax authorities if rent paid exceeds ₹2.4 lakh in a financial year. Form 15G can be used for the same purpose by individual tax less than 60 years or HUF receiving rental income.

TDS relief on interest on Post Office Deposits: Apart from bank deposits, post office fixed deposits and recurring deposits also feature the provision of TDS deduction on interest income of depositors. If you meet the required criteria, you must submit 15G or 15H to the post office and claim TDS relief on the interest earned from post office deposits.

TDS relief on Bond Payouts: Bonds are financial instruments that make periodic payouts to investors in the form of interest (coupon). Interest received from bonds in India is subject to TDS if annual income exceeds ₹5,000. In such cases e, eligible individuals or HUF can submit Form 15H or Form 15G with the deductor (bond issuer) and get relief from TDS on bond payouts is important to remember that Form 15G or Form 15H has to be submitted separately with each deductor to prevent TDS being deducted. Additionally, a fresh form with updated information must be submitted every year to receive this TDS relief without interruption.

What are the Different Parts of Form 15G

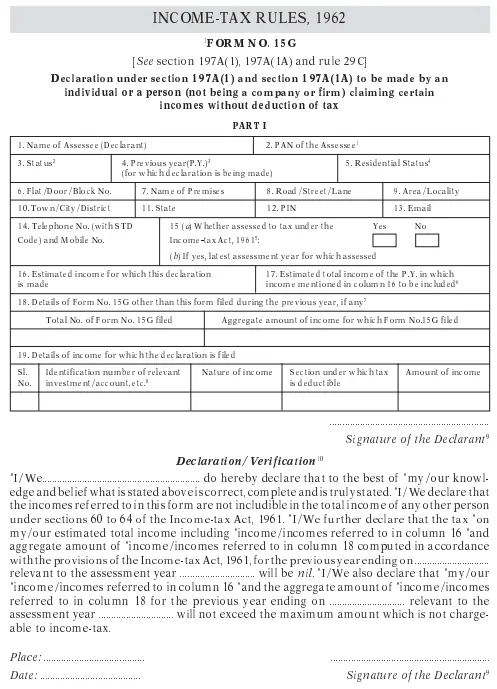

Form 15G consists of two parts: Part 1 and Part 2. The Part 1 of this form looks like this:

Form 15G Part 1 consists of multiple fields that need to be filled out by the individual claiming TDS deduction exemption. Some of these fields are personal details like

- Name,

- Address,

- Contact details,

- PAN,

- Estimated annual income,

- Financial year details,

- The total number of Form 15G for the applicable FY

- Aggregate Income,

- Place, date, signature of applicant/HUF, etc

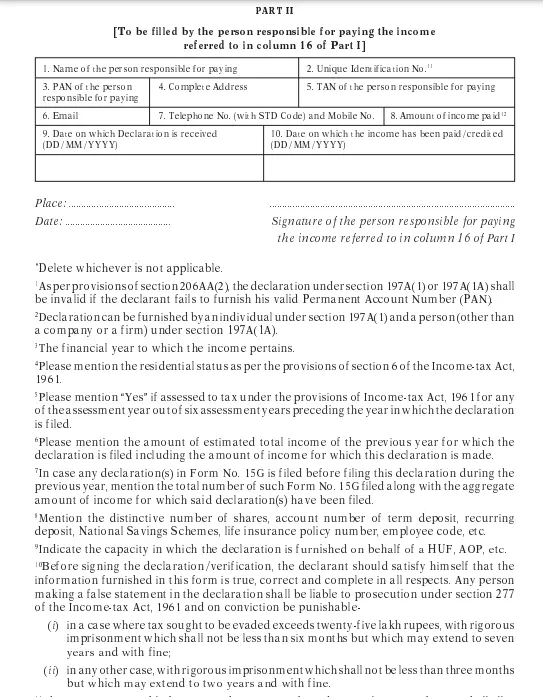

Part II of Form 15G looks like this:

Part 2 of the form contains details of the person/entity responsible for paying income to the declarant, like bank, tenant name, etc. Details to be filled include TAN, name, complete address, amount of income tax paid, date of declaration, etc. Part 2 of Form 15G is for official use and does not need to be filled out by the declarant.

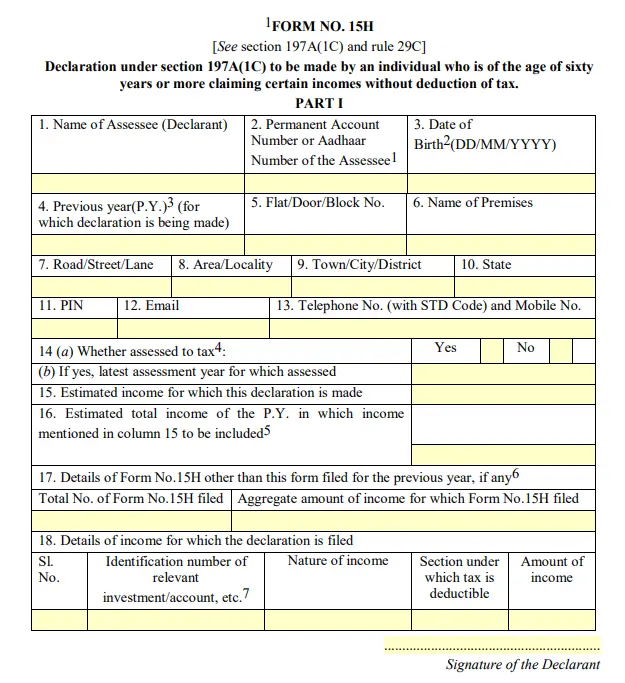

What are the Different Parts of Form 15H

Form 15H has 2 parts – Part I and Part II.

Part 1 is to be filled by the resident individual who is 60 or above and claiming a non-deduction of tax due to annual income below the taxable limit as per applicable income tax slabs and rates.

The following details need to be given at the time of filing it:

- Name, Address and contact details of the assessee

- Valid PAN or Aadhar number

- Date of Birth

- Declaration if you have been assessed to tax

- Approximate income for which assessment is being made

- Approximate income for the fiscal year

- Details of Form 15H submitted in the previous year

- Total number of Form 15H submitted till date

- Income for which 15H is filled: nature of income, the ID number of investment/account, etc.

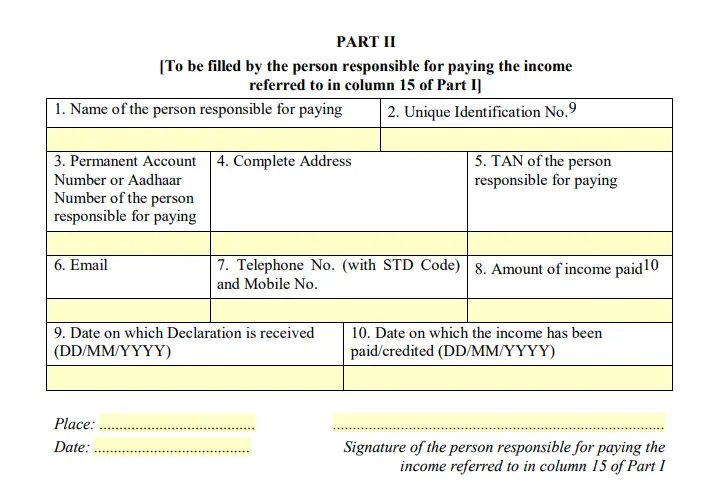

Part 2 of the form is for official use and is to be filled out by the person responsible for paying the income referred i.e. the deductor of TDS such as bank, post office, tenant, etc. or the deductor’s authorized representative. Part II of the 15H form looks like this:

Details of the deductor i.e. person/institution responsible for deducting TDS from income and depositing TDS collected are to be filled out in Form 15H, Part II. This includes:

- Name, address and contact details of the deductor (person/institution responsible for paying)

- Unique identification number

- PAN or Aadhaar number

- TAN of Deductor

- Amount of income paid for the applicable fiscal

- The date on which the declaration is received

- The date on which income has been paid out

What is the Right Time to Use Form 15G or 15H?

Under existing rules of the Income Tax Act, there is no time limit for submission of Form 15G or Form 15H. So, an eligible individual or HUF can choose to submit at any time during the year. But it is good practice to submit it at the start of every new financial year i.e. in April. This will reduce the chances of forgetting to submit the form before the TDS deduction is made on the accumulated income from interest, rental or bond payouts.

Things to Remember while Filing Form 15G and Form 15H

Here are a few additional details you need to be mindful of when filing the form:

- Do not submit the declaration if you have taxable income for the applicable financial year

- In case of fraudulent submission of these forms, the assessee be penalized under section 277 of the IT Act, 1961.

- The form is not a substitute for your Income Tax return form as you have to file ITR separately

- If you submit Form 15H/Form 15G late and the TDS is deducted, the fund on the excess TDS deducted can be claimed by filing an Income Tax Return.

- It is not mandatory to submit Form 15G/Form 15H, but it can prevent excess tax payouts if you are eligible for TDS relief.

- Non-resident Indians (NRIs) are not eligible to submit Form 15G or Form 15H as per current rule.s

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.