1. What Is A Primary Market & Functions Of Primary Market

What Is A Primary Market?

- The primary market is also known as the new issues market. It deals with new securities being issued for the first time. The essential function of a primary market is to facilitate the transfer of investible funds from savers to entrepreneurs seeking to establish new enterprises or to expand existing ones through the issue of securities for the first time.

- The investors in this market are banks, financial institutions, insurance companies, mutual funds and individuals.

Functions Of Primary Market:

In a primary Market, securities are created for the first time for investors to take. New securities are issued in this request through a stock exchange, enabling the government as well as companies to raise capital. Such a request is regulated by the Securities and Exchange Board of India (SEBI).

Some functions of Primary markets are-

- Origination:

It is the work that is before the issue is floated into the market. It is the stage where the initial groundwork is done. Through this, the issuer can understand the investment climate and whether the investors would subscribe to it or not. The underlying condition for this role is the time of floating of an issue, type of issue and price of the issue.

- Underwriting Services

One of the most vital aspects of offering a new issue offer is underwriting. The role of an underwriter in the primary marketplace is to buy unsold shares. Often financial institutions play the role of underwriters, earning a commission in the process.

Often investors depend on underwriters to gauge whether undertaking the risk would be worth the returns. It may also happen that the underwriter buys the entire IPO issue, subsequently selling it to investors.

- Distribution of New Issue

This is another vital function of the primary market. The distribution process is initiated with a new prospectus issue.

The public is invited at large to purchase the new issue, and detailed information is given on the company and the issue along with the underwriters.

Features Of Primary Market:

- The primary market deals with the new issue of securities. Any share, bonds, ETF or any marketable security, is first introduced in the primary market.

- Unlike the secondary market, the primary market has no physical existence, which exists in the form of stock exchanges.

- Security is floated on the primary market before going to the secondary market. Hence it precedes the secondary market.

2. Different Methods Of Raising Capital In Primary Market

Corporations may raise capital in the primary market by way of an initial public offer, rights issue or private placement.

Different Types Of Issues In the Primary Market:

- Public Issues:

When an issue/offer of securities is made to new investors for becoming part of the shareholders’ family of the issuer, it is called a public issue. Public issues can be further classified into Initial Public Offer (IPO) and Follow-on Public Offer (FPO).

- Rights Issues:

When a company raises funds from its existing shareholders by selling them new shares, it is called a rights issue. The offer document for a rights issue is called the Letter of Offer and the issue is kept open for 30-60 days.

- Bonus Issues:

The term bonus issue or bonus share issue is used to define an issue of bonus shares. Bonus shares are additional shares given by the company to existing shareholders, free of cost.

- Private Placements:

Private placements are used by companies to sell their securities to a select group of investors. Companies offer securities directly to a small group of investors in a private placement, usually with the support of an investment bank to identify possible buyers and fix the price of the securities. Two types of private placement are followed preferential allotment & Qualified institutional placement.

3. Public Issue

What Is A Public Issue

When an issue/offer of securities is made to new investors for becoming part of the shareholders’ family of the issuer, it is called a public issue. Public issues can be further classified into Initial Public Offer (IPO) and Follow-on Public Offer (FPO).

Types of Public Issue

- Initial Public Offerings

The initial public offering is the process by which a private company can go public by sale of its stocks to the general public. It could be a new, young company or an old company which decides to be listed on an exchange and hence goes public.

Companies can raise equity capital with the help of an IPO by issuing new shares to the public or the existing shareholders can sell their shares to the public without raising any fresh capital. A company offering its shares to the public is not obliged to repay the capital to public investors.

The company which offers its shares, known as an ‘issuer’, does so with the help of investment banks. After the IPO, the company’s shares are traded in an open market. Those shares can be further sold by investors through secondary market trading.

Initial Public Offering can be made through the fixed price method, book building method or a combination of both.

Types of IPO:

Fixed Price Issues –

- The price at which the securities are offered and would be allotted is made known in advance to the investors.

- Demand for the securities offered is known only after the closure of the issue

- 100% advance payment is required to be made by the investor at the time of application.

- 50 % of the shares offered are reserved for applications below Rs. 1 lakh and the balance for higher amount applications.

Book Building Issues –

- A 20% price band is offered by the issuer within which investors are allowed to bid and the final price is determined by the issuer only after closure of the bidding.

- Demand for the securities offered, and at various prices, is available on a real-time basis on the BSE website during the bidding period.

- A 10% advance payment is required to be made by the QIBs along with the application, while other categories of investors have to pay 100% advance along with the application.

- 50% of shares offered are reserved for QIBs, 35% for small investors and the balance for all other investors.

- Follow-on public offer (FPO)

When a listed company makes another public issue to raise capital, it is called follow-on offer (FPO). Since FPOs follow an IPO, they are also known as secondary offerings. The companies may choose to make further offerings to raise more equity and cut down on their debts.

How is an FPO different from an IPO?

The critical difference between an IPO and an FPO is the timing. IPOs are announced when the company’s shares are still unlisted and are offered to the public for the first time. In the case of FPO, the company has already listed its shares on a stock exchange and made an additional offer of shares to the public.

Types of FPO

Dilutive Follow-On Public Offer:

- Diluted FPO refers to when the company issues additional (new) shares and offers them to the public market.

- This type of FPO is made to fund the company’s expansion strategies, raise funding, or cut down the borrowings.

- Since the number of shares increases, the earnings per share (EPS) of the company decreases.

- The inflow of cash resulting from a dilutive FPO is good for the company’s long-run outlook.

Non-Dilutive Follow-On Public Offer:

- Non-dilutive FPO refers to when the existing shareholders sell off their privately held shares to the public.

- The sale proceeds are transferred directly to the shareholders selling them.

- In most cases, the shareholders who sell their private holdings are the company’s promoters, directors, or pre-IPO investors.

- No new shares are issued under non-dilutive FPO, and hence the Earnings Per Share (EPS) of the company remains unchanged.

- This type of FPO does not benefit the company much. It is mostly used to change the shareholding/ownership pattern of the company.

- Non-diluted FPOs are also known as secondary market offerings.

At The Market Offering:

- A third form of follow-on public offer (FPO) is called at the market offering.

- As a part of this offering, the issuing company informs the shareholders and the regulators that they intend to offer a certain number of shares. However, the date and price at which these shares are issued is not decided in advance.

- Instead, the company just keeps an eye on the share price every day. The day on which the share price increases is the day on which the company issues the additional shares. This helps the company raise maximum capital by selling a minimum amount of shares.

- The advice of investment bankers is invaluable for the company attempting to time the market to raise maximum capital

4. Private Placements

Private placements are used by companies to sell their securities to a select group of investors. Companies offer securities directly to a small group of investors in a private placement, usually with the support of an investment bank to identify possible buyers and fix the price of the securities.

Most countries require less disclosure for private placements than for public offerings because investors in private placements are believed to have adequate knowledge and expertise to recognize the risks they assume. As a result, private placements provide faster access to financing while requiring less regulatory scrutiny and costing less to comply with regulations than public offerings.

Two Types Of Private Placement Are Followed:

- Preferential Allotment:

Preferential allotment is the practice of issuing securities to a selected group of entities such as mutual fund companies, financial institutions or promoters at a particular price.

- Qualified Institutional Placement:

In this mode of private placement, a listed company can issue shares or other securities to only institutional buyers. It is a way of encouraging the listed companies to raise capital from the domestic market.

Advantages of Private Placement

- Speeds up financing: A company willing to raise capital through a fresh issue by going for a public issue of shares has to go through a lot of procedures that will be time-consuming. Whereas it becomes easier to raise capital from private placement within a few months.

- Economical: For public issues of shares, a company has to spend on the preparation and printing of prospectus, application forms, transportation and also on advertisement in various forms of media. All these expenses will not be required if a public placement route is selected.

- Confidentiality: In private placement, the shares are allotted to selected business groups and hence, the whole procedure is confidential, while in a public issue many disclosures need to be made.

- Market Stability: The private placement market is more stable as compared to the stock market. There is less volatility in the private placement market.

- Raising small capital: Small amounts of capital can be raised through private placement, whereas public issue is required when the capital requirement is high.

5. Rights Offering

When a company raises funds from its existing shareholders by selling them new shares, it is called as rights issue. The offer document for a rights issue is called as the Letter of Offer and the issue is kept open for 30-60 days. Existing shareholders are entitled to apply for new shares in proportion to the number of shares already held.

The rights that existing shareholders receive are often known as pre-emptive rights because existing shareholders have the right of first refusal on any new equity offerings. Without such rights, the issuing company’s management could dilute (reduce) the ownership interests of existing investors.

Features Of A Rights Issue

- Companies undertake a rights issue when they need cash for various objectives. The process enables the company to raise money without incurring underwriting fees.

- A rights issue gives preferential treatment to existing shareholders, where they are given the right (not obligation) to purchase shares at a lower price on or before a specified date.

- Existing shareholders also enjoy the right to trade with other interested market participants until the date at which the new shares can be purchased. The rights are traded in a similar way as normal equity shares.

- The number of additional shares that can be purchased by the shareholders is usually in proportion to their existing shareholding.

- Existing shareholders can also choose to ignore the rights; however, if they do not purchase additional shares, then their existing shareholding will be diluted post issue of additional shares.

Reasons For A Rights Issue

- When a company is planning an expansion of its operations, it may require a huge amount of capital. Instead of opting for debt, they may like to go for equity to avoid fixed payments of interest. To raise equity capital, a rights issue may be a faster way to achieve the objective.

- A project where debt/loan funding may not be available/suitable or expensive usually makes a company raise capital through a rights issue.

- Companies looking to improve their debt-to-equity ratio or looking to buy a new company may opt for funding via the same route.

- Sometimes troubled companies may issue shares to pay off debt in order to improve their financial health.

Example Of A Rights Issue

Let’s say an investor owns 100 shares of Vodafone and the shares are trading at Rs.10 each. The company announces a rights issue in the ratio of 2 for 5, i.e., each investor holding 5 shares will be eligible to buy 2 new shares. The company announces a discounted price of, for example, Rs.6 per share. It means that for every 5 shares (at Rs.10 each) held by an existing shareholder, the company will offer 2 shares at a discounted price of Rs.6.

Investor’s Portfolio Value (before rights issue) = 100 shares x 10 = Rs. 1,000

Number of right shares to be received = (100 x 2/5) = 40

Price paid to buy rights shares = 40 shares x Rs.6 = Rs. 240

Total number of shares after exercising rights issue = 100 + 40 = 140

Revised Value of the portfolio after exercising rights issue = Rs.1,000 + Rs.240 = Rs. 1,240

Should be price per share post-rights issue = Rs.1,240 / 140 = Rs.8.86

According to theory, the price of the share after the rights issue should be Rs.8.86, but that is not how the markets behave. An uptrend in the share price will benefit the investor, while if the price falls below Rs. 8.86, the investor will lose money.

6. Bonus Issue

- The term bonus issue or bonus share issue is used to define an issue of bonus shares. Bonus shares are additional shares given by the company to existing shareholders, free of cost. These are the company’s accumulated earnings which are not given out in the form of dividends but are converted into free shares.

- There are certain situations when a company is unable to pay dividends in cash, because of a possible shortage of liquid funds, despite having a profitable turnover. In such cases, the company issues bonus shares to the current shareholders instead of paying the dividend in cash. Bonus shares are issued as new or additional shares, free of cost and in proportion to the shares and dividends held by the shareholder.

- Companies often issue bonus shares, even if they do not face a shortage of liquid funds. This is a strategy employed by certain companies to avoid the highly levied Dividend Distribution tax, which has to be paid when declaring dividends.

- The basic principle behind bonus shares is that the total number of shares increases with a constant ratio of number of shares held to the number of shares outstanding. For instance, if Investor A holds 200 shares of a company and a company declares 4:1 bonus, that is for every one share, he gets 4 shares for free. That is total 800 shares for free and his total holding will increase to 1000 shares.

Who is eligible for Bonus Shares:

- The eligibility for bonus shares depends on the record date and ex-date of the shareholders. The record date is a cut-off date set by the company and the investors must be shareholders of the company before this date for them to be eligible to receive bonus share issue. Besides, the ex-date is a day preceding the record date set by the company.

- In India, the delivery of shares into a Demat account takes place after 2 days from the trading date. All existing shareholders before the ex-date and record date are eligible to receive bonus shares issued by a company. However, to qualify to receive bonus shares, the company stocks must be bought before the ex-date.

- Any stocks bought on the ex-date shall not be eligible for an issue of bonus shares as the ownership of the stocks cannot be gained by the investor before the record date.

Advantages of Bonus Shares

- From Investor Point of View

- Investors do not have to pay any tax while receiving bonus shares from the company.

- Bonus shares are considered beneficial for long-term shareholders of the company looking to multiply their investment.

- Bonus shares are free of cost to shareholders as they are issued by the company, which increases the outstanding shares of an investor in the company and enhances the liquidity of the stock.

- Bonus shares help build the trust of an investor in the company’s business and operations because they have invested in the company and, in turn, gives capital to the investor.

- From Company Point of View

- The issue of bonus shares enhances the company’s value and increases positions and image in the market, gaining the trust of existing shareholders and attracting several small investors to be a part of the stock market.

- The companies have more free-floating shares with the issue of bonus shares in the market.

- Issue of Bonus shares benefits companies to get themselves out of the situation where they are not able to or simply not prefer to pay cash dividends to their shareholders.

Disadvantages of Bonus Issue

- From Investor’s Point of View

- There is no much of a disadvantage of owning the bonus shares from an investor’s point of view. However, they should know about receiving bonus shares because the profit will remain the same, but the number of shares will be increased as the earning per share will fall.

- From Company’s Point of View

- The company do not receive any cash while issuing bonus shares. As a result, the ability to raise money by following an offering is minimized.

- When a company keep on issuing bonus shares instead of paying dividends, the cost of the bonus issued keeps adding up over the years.

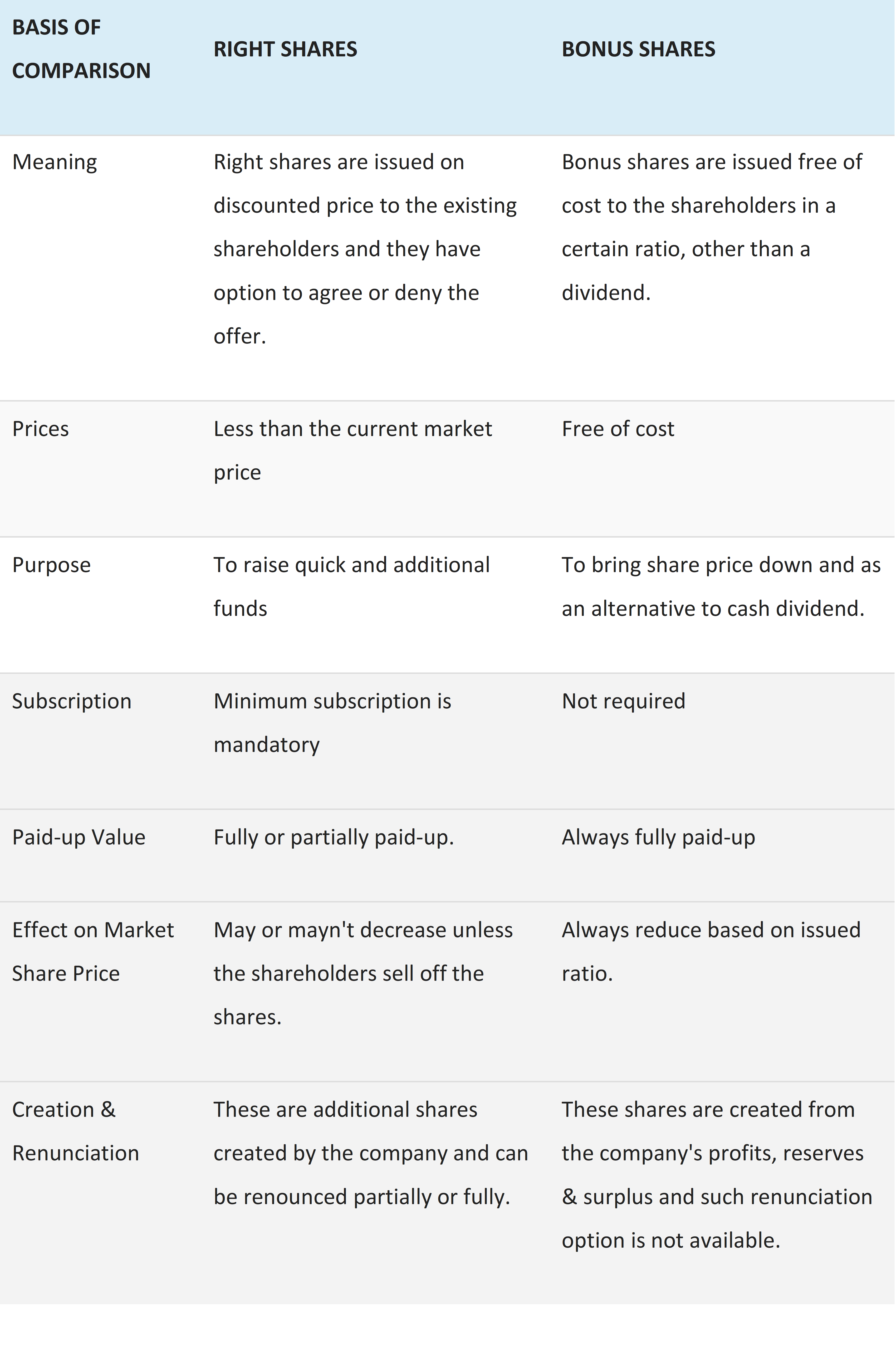

7. Difference Between Bonus Shares & Rights Issue

Difference Between Right Shares V/S Bonus Shares

8. Participants In The Primary Market

Corporations, institutions, investment banks, and public accounting companies are the four main players in the primary market. Corporations issue debt or equity to institutions in exchange for their capital investment, whereas institutions invest capital in corporations that want to expand and grow their enterprises. Institutions and corporations are matched with investment banks depending on their risk profile and investment style. Finally, public accounting firms are in charge of financial statement production, review, and auditing, as well as tax work, accounting system consulting, mergers and acquisitions, and capital raising. As a result, public accounting companies in the primary market help corporations not only obtain capital but also prepare, analyse, and audit financial statements to guarantee that their financial performance is accurately represented.

Participants In Primary Market:

- Corporations

Corporations function like running businesses in the capital markets, requiring funds to expand and run their operations. The industry, size, and location of these businesses might all be different.

- Institutions (Fund Managers on the “Buy Side”)

Fund managers, institutional investors, and individual investors make up institutions. These investment managers supply funds to companies that require it in order to expand and function. Corporations issue debt or equity to institutions in the form of bonds or shares in exchange for their capital. The cycle of the two primary actors in the capital markets is completed by the exchange of capital and debt or equity.

- Investment Banks (also known as “Sell Side”)

Investment banks are engaged to act as a middleman, facilitating transactions between firms and organisations. Investment banks’ job is to match institutional investors with corporations based on their risk and return expectations, as well as their investment philosophies. Investment banking jobs entail a lot of financial modelling and value analysis.

- Firms that provide public accounting services

Public accounting companies can play a variety of functions in the main market, depending on their divisions. Financial reporting, auditing financial accounts, taxes, accounting system consultancy, M&A counselling, and capital raising are all examples of these roles. As a result, corporations frequently use public accounting firms for accounting and counselling services.

9. Value At Which Securities Are Issued In Primary Market

The Securities Issued To The Investors In The Primary Market At:

- Face value or Par ValueThe face value of a share is the value at which the share is listed on the stock market. Face value is also called par value. The face value is determined when the company issues shares to raise capital. Hence, one cannot calculate the face value. It remains fixed and never changes. However, if a company decides to split the shares, then the face value can change.Mostly, Indian company shares have a face value of Rs.10. The face value is significant in the stock market for legal and accounting reasons. When a shareholder buys a stock, the company issues a share certificate that has face value mentioned.Formula:Face value of a share = Equity share capital / Outstanding number of shares

- Premium ValueA premium on stock occurs when the stock’s par value is lower than the issuing price. The difference between the lower par value and the higher issuing price is considered the stock premium. This shows the amount of money that investors are willing to pay over the par value for the stock.Let us consider a simple example. Say Mr. Sushant is running a chain of cafe with 4 more shareholders. Mr. Sushant wants to issue an additional 2,500 shares of Rs.10 par stock to new investors for raising additional capital for expansionary projects. As the restaurant is performing exceptionally well, and the investors recognize future potential, the investors are willing to pay Rs.30 for every share. In this case, the difference of Rs.20 is the premium amount on the stock.

- Discount ValueA discount on stock occurs when the stock’s par value is higher than the issuing price. The difference between the greater par value and the lesser issue price is considered the discount.Example- ABC Limited Company is seeking out new investors and trying to sell its Rs.10 par value stock. Unfortunately, there isn’t much interest in the company and ABC could only find one investor who is willing to purchase 1,000 shares for Rs.5 per share. ABC limited company agrees to the price and issues 1,000 new shares to the investor. This issuance would be called as an issuance at a discounted value.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.