1. Mutual Funds

A mutual fund is an investment program that is professionally managed and diversified in its investments.

The process involves professionals using the funds of retail investors to invest in a carefully selected set of investment products to build a diversified portfolio. The professionals who are responsible for managing a mutual fund are known as fund managers.

A fund manager is an expert who is well-versed in how the stock market works. He / She aims to build a portfolio that performs a certain market index.

Suppose you wanted to buy a pizza, but you have money that’s worth half the cost of the pizza. The only solution here would be to find another person, who is interested in buying the other half of the pizza with you.

Why? Because –

- The pizza shop will not sell you only half a pizza; and

- Doing so will get you the exact amount of pizza you wanted, at the exact amount of money you wanted to spend.

Advantages of Mutual Fund

- Simple Concept

The concept and management of a mutual fund investment is very simple. You choose the fund and invest in it, and the rest of the decisions will be handled by the fund managers

- Variety of Products

The mutual fund industry offers a huge number of schemes. They are built to cater to the different types of investors present in the market based on the duration of investments, and the risk appetite of investors

- Diversifying our Portfolios

A mutual fund is a set of different types of investment products. When we put money in a mutual fund, it automatically diversifies our portfolio.

- Professional Fund Management

The biggest advantage of putting our money in a mutual fund comes from the professional management that our investment receives

2. What Is The Regulatory Body For Mutual Funds?

As far as mutual funds are concerned, SEBI formulates policies, regulates and supervises mutual funds to protect the interest of the investors. SEBI notified regulations for mutual funds in 1993. Thereafter, mutual funds sponsored by private sector entities were allowed to enter the capital market. The regulations were fully revised in 1996 and have been amended thereafter from time to time. SEBI has also issued guidelines through circulars to mutual funds from time to time to protect the interests of investors.

All mutual funds whether promoted by public sector or private sector entities including those promoted by foreign entities are governed by the same set of Regulations. There is no distinction in regulatory requirements for these mutual funds and all are subject to monitoring and inspections by SEBI

Association of Mutual Funds in India (AMFI)

AMFI is an industry-standard organization for all mutual funds in the country. It is a not-for-profit organization that aims to spread investor awareness about the mutual funds industry

Objectives of AMFI

- To outline the ethical and uniform professional standards for every mutual fund operating under the association;

- To encourage its members and investors to maintain ethical business practices and regulations;

- To get AMCs, agents, distributors, advisories and other bodies involved in the capital market to comply with their guidelines;

- To help investors air their grievances and register complaints against a fund manager or the fund house;

- To distribute information on the Mutual Fund Sector and conduct research and workshops on various funds; and

- To spread awareness about the regulations regarding safe mutual fund investments throughout the country

How Is A Mutual Fund Set Up?

- A mutual fund is set up in the form of a trust, which has a sponsor, trustees, Asset Management Company (AMC) and custodian. The trust is established by a sponsor or more than one sponsor who is like a promoter of a company. The trustees of the mutual fund hold its property for the benefit of the unitholders. AMC approved by SEBI manages the funds by making investments in various types of securities.

- The custodian, who is required to be registered with SEBI, holds the securities of various schemes of the fund in its custody. The trustees are vested with the general power of superintendence and direction over AMC.

- They monitor the performance and compliance of SEBI Regulations by the mutual fund. SEBI Regulations require that at least two-thirds of the directors of a trustee company or board of trustees must be independent i.e. they should not be associated with the sponsors. Also, 50% of the directors of AMC must be independent. All mutual funds are required to be registered with SEBI before they launch any scheme.

3. What Is NAV?

- The performance of a particular scheme of a mutual fund is denoted by Net Asset Value (NAV). Mutual funds invest the money collected from investors in securities markets. In simple words, NAV is the market value of the securities held by the scheme. Since the market value of securities changes every day, the NAV of a scheme also varies on a day-to-day basis

- The NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on any particular date. For example, if the market value of securities of a mutual fund scheme is INR 200 lakh and the mutual fund has issued 10 lakh units of INR 10 each to the investors, then the NAV per unit of the fund is INR 20 (i.e.200 lakh/10 lahks). NAV is required to be disclosed by the mutual funds daily

What Are Net Assets Of A Mutual Fund And How Are They Valued?

The net assets of a mutual fund include all the resources that have been invested into the stocks of the mutual fund scheme.

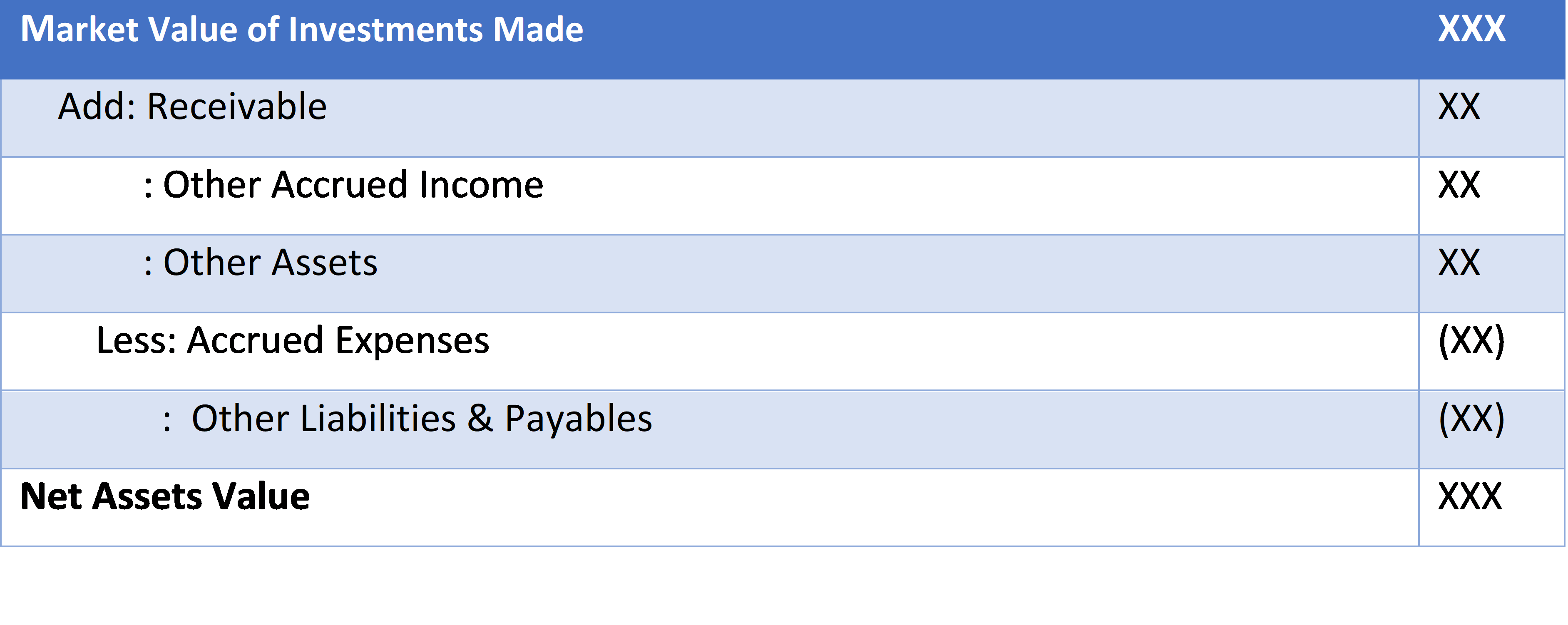

The Net Assets of a mutual fund are calculated as follows:

How Frequently Is The NAV Calculated?

The NAV of every fund is calculated at the end of every market day (business day), on the basis of the closing market prices of the securities that the fund or scheme is invested in. Any changes in the NAV indicate a rise or a dip in the prices of assets of the mutual fund scheme.

4. Risks Involved In Mutual Funds

“Mutual Funds are subjected to market risk. Read all scheme related documents carefully.” This line is so popular. As we all have heard this in tv ads. So, what this tells us is- Yes, Mutual Funds are subjected to not only market risks but other various types of risks.

Below are some risks involved in Mutual Funds: –

Market Risks

The most known and normal danger for any speculation vehicle is market risk. Market risk is essentially the likelihood that the market or the economy will decrease, making individual speculations lose esteem paying little heed to the exhibition.

Inflation Risks

The danger that increasing financing costs will make your shared assets decrease in esteem. At the point when financing costs rise, security costs decrease and security common assets may likewise decay subsequently. In basic terms, if your shared assets make 10% each year and the typical cost for basic items increases 6% you are simply left with 4% as net returns from your ventures.

Volatility Risk

The risk of losses due to the changes of prices of securities due to the change in the volatility of the market instruments. Market volatility indicates the degree of change of the price of an instrument being traded on the market.

Interest Rate Risks

The risk of the value of fixed-income securities going down due to a rise in the interest rates is known as the interest rate risk.

How Do We Measure The Risks Involved In A Mutual Fund?

- Alpha

Alpha is the excess returns relative to market benchmark for a given amount of risk taken by the scheme. Put simply, it measures how much better a fund has performed as compared to its benchmark index. For instance, if the NIFTY 50 index delivered 10% in the past year and the fund benchmarked against the NIFTY 50 delivered 11%, then the Alpha is +1%. And if the fund underperformed and achieved only 8%, then the Alpha is -2%.

Therefore, actively managed funds can have positive or negative Alpha depending on how well the fund manager runs the fund. In fact, creating positive Alpha is the entire essence behind someone investing in an actively managed fund. Index Funds, on the other hand, will not produce any Alpha.

- Beta

Beta is a commonly used risk measure and calculates the relative volatility of a stock or Mutual Fund’s returns as against its benchmark. So, Beta merely explains the relative riskiness of an asset and does not give the inherent risk of the asset itself.

Beta is measured against a benchmark. In other words, the default Beta of the stock market or the benchmark will always be the numeric value 1. Since the Mutual Fund returns are measured against the benchmark, the value of Beta can be anything.

For example, if the Beta of a Mutual Fund scheme is 1, it means the fund moves in line with the benchmark. So if the NIFTY 50 moves up by 1%, the fund is likely to go up by 1%. To put it in another way, Index Funds have a Beta of 1.

Likewise, say the Beta of a fund is higher than 1. Assume it is 1.5. So, if the NIFTY 50 jumps by 1%, the fund benchmarked against NIFTY 50 is likely to go up by 1.5%. A similar pattern is followed where the Beta is lower than 1 as well.

Standard Deviation

- The standard deviation measures the dispersion of data from its mean. And from a Mutual Fund perspective, it represents the volatility or riskiness of the fund.

- For instance, let’s say a Mutual Fund delivers 10% average returns over a period of time. But as expected, this fund has had some good months and also some bad months with returns moving between +20% and -15%.

- This up and down trajectory of returns in the Mutual Fund NAV is what standard deviation captures and presents as an annualized number.

- For instance, let’s say this fund that delivers a 10% average return & has a standard deviation of 3%. As a rule of thumb, this means 68% of the time. You can expect the fund’s returns to be between a lower value of 7% (10%-3%) and a higher value of 13% (10% + 3%).

- As a rule, the higher the standard deviation, the more volatile the Mutual Fund on a historical basis. Typically, the Sectoral Funds or Thematic Funds like Banking and Infrastructure Funds and even Small Cap Funds would have a high standard deviation due to the high volatility in annual returns with these funds.

5. What Are The Different Types Of Mutual Funds?

Schemes According To Maturity Period

A mutual fund scheme can be classified into open-ended scheme or close-ended scheme depending on its maturity period.

- Open-ended Fund/Scheme

An open-ended fund or scheme is one that is available for subscription and repurchase on a continuous basis. These schemes do not have a fixed maturity period. Investors can conveniently buy and sell units at Net Asset Value (NAV) per unit which is declared on a daily basis. The key feature of open-end schemes is liquidity.

- Close-ended Fund/Scheme

A close-ended fund or scheme has a stipulated maturity period e.g. 3-5 years. The fund is open for subscription only during a specified period at the time of launch of the scheme. Investors can invest in the scheme at the time of the new fund offer and thereafter they can buy or sell the units of the scheme on the stock exchanges where the units are listed. In order to provide an exit route to the investors, some close-ended funds give an option of selling back the units to the mutual fund through periodic repurchase at NAV related prices. SEBI Regulations stipulate that at least one of the two exit routes is provided to the investor i.e. either repurchase facility or through listing on stock exchanges

Schemes according to Investment Objective

A scheme can also be classified as growth scheme, income scheme or balanced scheme considering its investment objective. Such schemes may be open-ended or close-ended schemes as described earlier.

- Growth/Equity Oriented Scheme

The aim of growth funds is to provide capital appreciation over the medium to long- term. Such schemes normally invest a major part of their corpus in equities. Such funds have comparatively high risks. These schemes provide different options to the investors like dividend option, growth, etc. and the investors may choose an option depending on their preferences. The investors must indicate the option in the application form. The mutual funds also allow the investors to change the options at a later date. Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time.

- Income/Debt Oriented Scheme

The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate debentures, Government securities and money market instruments. Such funds are less risky compared to equity schemes. However, opportunities of capital appreciation are also limited in such funds. The NAVs of such funds are affected because of change in interest rates in the country. If the interest rates fall, NAVs of such funds are likely to increase in the short run and vice versa. However, long term investors may not bother about these fluctuations.

- Balanced/Hybrid Scheme

The aim of balanced schemes is to provide both growth and regular income as such schemes invest both in equities and fixed income securities in the proportion indicated in their offer documents. These are appropriate for investors looking for moderate growth. They generally invest 40-60% in equity and debt instruments. These funds are also affected because of fluctuations in share prices in the stock markets. However, NAVs of such funds are likely to be less volatile compared to pure equity funds.

Money Market or Liquid Schemes

These schemes are also income schemes and their aim is to provide easy liquidity, preservation of capital and moderate income. These schemes invest exclusively in short-term instruments such as treasury bills, certificates of deposit, commercial paper and inter-bank call money, government securities, etc. Returns on these schemes fluctuate much less compared with other funds. These funds are appropriate for corporate and individual investors as a means to park their surplus funds for short periods.

Gilt Funds

These funds invest exclusively in government securities. Government securities have no default risk. NAVs of these schemes also fluctuate due to change in interest rates and other economic factors as is the case with income or debt-oriented schemes.

Index Funds Index

Funds replicate the portfolio of a particular index such as the BSE Sensitive index (Sensex), NSE 50 index (Nifty), etc. These schemes invest in the securities in the same weightage comprising of an index. NAVs of such schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same percentage due to some factors known as “tracking error” in technical terms. Necessary disclosures in this regard are made in the offer document of the mutual fund scheme.

6. What Are The Rights That Are Available To Mutual Funds Holders In India?

As per SEBI Regulations on Mutual Funds, an investor is entitled to:

- Receive Unit certificates or statements of accounts confirming your title within 6 weeks from the date your request for a unit certificate is received by the Mutual Fund.

- Receive information about the investment policies, investment objectives, financial position and general affairs of the scheme

- Receive dividend within 30 days of their declaration and receive the redemption or repurchase proceeds within 10 days from the date of redemption or repurchase.

- The trustees shall be bound to make such disclosures to the unit holders as are essential in order to keep them informed about any information, which may have an adverse bearing on their investments.

- 75% of the unit holders with the prior approval of SEBI can terminate the AMC of the fund.

- 75% of the unit holders can pass a resolution to wind-up the scheme.

- An investor can send complaints to SEBI, who will take up the matter with the concerned Mutual Funds and follow up with them till they are resolved.

7. What Is A Fund Offer Document?

The first and foremost document of a mutual fund is standard scheme offer document. The purpose of a scheme offer document is to provide essential information about the scheme in a way that will assist investors in making informed decisions about whether to purchase the units being offered. These Offer document consists of two parts:

Scheme Information Document (SID)

SID carries important information about the scheme(s) such as their investment objective, asset allocation pattern, investment strategies, risk involved, benchmark indices for respective scheme(s), who will manage the scheme(s), fees & expenses; amongst a host of others for making an informed investment decision.

Statement of Additional Information (SAI)

SAI contains all statutory information of the Mutual Fund house.

- Both SID and SAI are prepared in a format prescribed by the security market regulator SEBI and submitted to it. The content of the document needs to flow in the sequence prescribed in the format.

- In addition, the mutual fund is permitted to add any disclosure that it feels is material for the investor. The other information in SID includes dividends and distributions, Inter scheme transfers, Associate transactions, Borrowing by the mutual fund, NAV and Valuation of assets of the scheme, Redemption or repurchase, Accounting policies, Tax treatment, and Investors’ rights and services are other important aspects.

8. What Is Active Fund Management?

- Active management is the use of human capital to manage a portfolio of funds. Active managers rely on analytical research, personal judgment, and forecasts to make decisions on what securities to buy, hold, or sell.

- Active management is an investment strategy that tries to create excess returns through the recognition, anticipation, and exploitation of short-term investment trends.

- The main intention of extensive activity of buying and selling of assets or securities is to outdo the markets collectively. Active management of investments is targeted at making the most out of the market situation, especially when the markets are on the upward movement.

- Active management of mutual funds involves fund managers juggling across various debt or equity instruments in pursuit of making good profits. However, this is beneficial when the markets are fluctuating.

9. What Is Passive Fund Management?

- Passive management of investments is a method in which the fund managers or the investors implement a laidback approach. This involves tracking a benchmark index to replicate its performance. The primary intention of the passive way of managing investments is to generate returns similar to a benchmark index.

- This can be done by investing in the same securities that the benchmark index is made up of. The idea here is not to outdo the benchmark but to generate returns that are in line with it. Unlike investments that are actively managed, the passively managed investments don’t need a team of experts who regularly track market performance. This is because the securities and assets don’t change frequently.

- The most popular examples of passively managed investments are index mutual funds and exchange-traded funds(ETFs). Here, the fund manager does nothing more than replicating the performance of the benchmark indices being tracked.

10. What Is An ETF?

- ETFs are mutual fund units that investors can buy or sell at the stock exchange. This is in contrast to a normal mutual fund unit that an investor buys or sells from the AMC (directly or through a distributor). In the ETF structure, the AMC does not deal directly with investors or distributors.

- Units are issued to a few designated large participants called Authorised Participants (APs).

- The APs provide buy and sell quotes for the ETFs on the stock exchange, which enable investors to buy and sell the ETFs at any given point of time when the stock markets are open for trading. ETFs therefore trade like stocks and experience price changes throughout the day as they are bought and sold. Buying and selling ETFs requires the investor to have demat and trading accounts

11. Must Know Concepts

Expense Ratio

- Expense ratio is the fee that is charged by an Asset Management Company for managing the assets to manage the funds of the investors.

- For instance: An investor invests Rs 100000 and the expense ratio is 2%, then Rs 2000 is used for the expenses involving the management of the fund. The investment companies incur various costs for managing the funds. Some of these include advertisement and promotion costs, fund manager fees, etc.

AUM stands for assets under management

- A particular fund house has multiple schemes. Every scheme has investors who have invested their money into this. The total of all the investors in all schemes put together is termed as assets under management. It is the total market value of assets that an investment company manages on behalf of its investors

Exit Load

- Exit load refers to that fee which an investor has to pay for leaving the scheme before a predetermined period. For instance: Suppose, the exit load is 1% for 1 year. It means that the investor will have to shell out 1% of his total investment value if he plans to withdraw his fund before 1 year. After 1 year, no exit load is charged.

- This is basically enacted to ensure that the investor invests for the long term and does not pull out his funds immediately.

Factsheet

- A factsheet is a document which gives an overview of a mutual fund. It contains the list of securities that the fund has invested in and also contains other data such as 1 year, 3-year, 5 year and since inception returns.

- It also contains the different ratios for example, the sharpe ratio, the point to point returns etc. An investor can go through this sheet to ascertain whether he is invested in the right scheme based on the holdings of that particular fund.

Benchmark

- A benchmark is a standard against which the performance of a security, a mutual fund or a fund manager can be ascertained. It is a preset list of securities which is used for the comparison with an actual portfolio. Benchmarks are usually broad market indices like BSE Sensex, CNX Nifty which are used to compare the different mutual funds

Total Return Index

- It is a type of equity index which tracks the capital gains of a group of stocks and assumes that the dividends are added back to the index.

- When we assume this, it means that the dividends that are received from the stock are reinvested back into the same stock from which dividend has been received.

SIP

- An SIP, or a Systematic Investment Plan is the process of investing periodically be it weekly, fortnightly, monthly or quarterly.

- Here the investment is done irrespective of whether the markets are up or down. In case the NAV is down, more units are purchased and in case the NAV is up, lesser units are bought. This helps in investing over the long term after taking into account the bull run and the bear run.

- It is like an EMI where installments accrue for a specific wealth creation goal. An investor might choose multiple SIPs for different goals. The biggest benefit is that in this one does not need to time the markets.

SWP

- A Systematic Withdrawal Plan (SWP) w.r.t. to a mutual fund scheme allows an individual to withdraw funds periodically by selling off the proportionate units of the scheme.

- An individual might need monthly cash inflows when he retires or even for other necessary expenses which he incurs on a monthly basis. Therefore, when he puts his money in a mutual fund, and then sets up an SWP on that fund, he will

- receive periodical payments through deductions from the fund. This can serve as an alternate source of income for investors.

STP

- An STP, short for Systematic Transfer Plan, is a scheme that allows an investor to transfer funds or units from one scheme to another offered by the same mutual fund house.

- An investor can use this system to maintain a balance between their investments in two different segments of the market. This ensures diversification of funds and protects investors from concentration risk as well.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.