1. Based On Structure

In India, mutual funds are classified into three types based on their investing structure, i.e. open-ended or closed-ended or interval funds. The distinction between open-ended and closed-ended funds is based on investing flexibility and how easily they may be purchased. While open-ended funds can be purchased and sold at any time, closed-ended funds can only be purchased at the time of its introduction and can only be repaid once the fund’s investment period has concluded.

Close Ended Funds

- Participation in a closed-ended mutual fund scheme is locked in for a set length of time. Close-ended plans can only be subscribed to during the new fund offer period (NFO) and the unit can only be redeemed once the lock-in period or the funds term has expired.

- This means that new investors cannot enter, nor can the existing investors exit till the term of the scheme ends. However, to provide a platform for investors to exit before the term, the fund houses list their closed-ended schemes on a stock exchange.

- Trading on a stock exchange enables investors to buy and sell units through a broker in the same manner as transacting the shares of a company. The units may trade at a premium or discount to the NAV depending on the investors’ expectations of the fund’s future performance and prospects. The demand and supply of fund units and other market factors also affect their price.

- The number of outstanding units of a closed-ended fund does not change as a result of trading on the stock exchange. Apart from listing on an exchange, these funds sometimes offer to buy back the units, thus offering another avenue for liquidity

- Some closed-ended funds, nevertheless, become open-ended once the lock-in period expires, or AMCs may transfer the assets of closed-ended funds to another open-ended fund after the maturity term. However, this requires the approval of the closed-ended fund’s shareholders.

Open Ended Funds

- The name open-ended funds come from the fact that they are always available for investment and redemption. In India, open-ended funds are the most popular type of mutual fund. These funds have no lock-in time or maturity dates, so they are always available. In practice, open-ended funds have no upper limit on the amount of money they can accept from the public (in terms of AUM). The NAV is determined daily in open-ended funds based on the value of the securities in the portfolio at the finish of each day. Typically, these funds are not allowed to invest.

- People regularly ask whether open-ended or closed-ended mutual funds are better. Generally- open-ended funds are a better option because they allow you to invest whenever you want based on your surpluses and liquidity. Open-ended funds are also a preferable alternative because you can buy with a small amount and invest over time through SIPs to accomplish your financial objectives. These are the substantial variations between open-ended and closed-ended mutual funds, which give open-ended mutual funds the upper hand.

Interval Funds

These schemes are a cross between an open-ended and a close-ended structure. These schemes are open for both purchase and redemption during pre-specified intervals (viz. monthly, quarterly, annually etc.) at the prevailing NAV-based prices. Interval funds are very similar to close-ended funds, but differ on the following points:-

- They are not required to be listed on the stock exchanges, as they have an in-built redemption window.

- They can make fresh issues of units during the specified interval period, at the prevailing NAV-based prices.

- The maturity period is not defined.

Interval funds have a unique feature of investing in illiquid assets which are not listed on exchanges. These assets may be in the form of forestry tracts, private assets, commercial property and business loans. Investors who are looking to get exposure to such unconventional assets may think of investing in Interval Funds.

2. Based On Investment Objective

Equity Mutual Fund

- A mutual fund that invests mostly in stocks is known as an equity fund. It can be handled actively or passively (through an index fund). Stock funds are another name for equity funds.

- In another perspective, Mutual funds that engage largely in stocks are known as equity funds. You put money into the fund in the form of a SIP or a lump sum, and it invests it in various equity stocks on your behalf. The resulting profits or losses in the strategy have an impact on the Net Asset Value of your fund (NAV).

- To create returns, an equity fund invests primarily in the stocks of various companies. When compared with other types of mutual funds, equity fund investments are associated with a higher level of risk. Furthermore, there is no such thing as a “one-size-fits-all” equity fund. There are many different types of equity funds, each with its own investing goal, that must be matched to your risk profile.

Benefits of Investing In Equity Funds

- Inflation-beating returns:

Among all other investments, equity fund schemes have historically been able to provide market-beating and inflation-beating returns. Most safe investments like fixed deposits, recurring deposits, etc. offer a rate of interest that provides little to no increase in money value after accounting for inflation.

- Diversified portfolio:

Investing in an equity mutual fund scheme means that the investor will hold a huge number of stocks and shares of various companies across different business processes, themes, sectors, etc. Holding a wide variety of stocks in one’s portfolio ensures that no great losses occur which cannot be offset by gains in another part of the portfolio.

- Capital appreciation:

As one of the only financial products that can provide real market and inflation-beating returns, equity mutual fund schemes are the only real option for those who wish to invest and grow their capital over the medium to long term.

- Liquidity:

Stocks and shares are traded across all major worldwide exchanges daily. While not immediately as liquid as withdrawing funds from a savings bank account, the liquidity offered is far higher than most other mutual fund schemes or investment plans.

3. Types of Equity Fund

Index Fund

- Index Funds are investment vehicles based on stock indices such as the Sensex or the Nifty. These indices are based on the free-float market capitalisation of India’s largest corporations. The goal of an Index Fund is to replicate the identical profile of the index it is monitoring, for example, a Sensex Index Fund will contain all 30 firms that make up the Sensex in the same ratio of weights as they do in the Sensex.

- The term “indexing” refers to a type of passive wealth management. Instead of actively stock selecting and timing the market, deciding which securities to invest in and when to buy and sell them- a fund portfolio manager develops a portfolio whose holdings mirror those of a specific index. The theory is that by replicating the index’s profile- the stock market as a whole or a broad section of it- the fund will be able to equal its profitability.

- The bulk of index funds in India focus on the front indexes such as the Nifty, Nifty Next50, SENSEX, and others, which are also used as benchmarks by large-cap mutual funds.

Large Cap Funds

- Large-cap equity Funds invest a large portion of their corpus in companies with large market capitalization are called large-cap funds. The top 100 stocks by market capitalization are large-cap stocks. This type of fund is known to offer stability and sustainable returns, over some time. Investors buy stocks or shares in well-known blue-chip firms that use the Nifty as a market index. Investing in large renowned companies ensures low risk while also yielding high rewards.

- These funds have a reputation for providing stable returns. When compared to small or mid-cap corporations, the organizations in which large-cap funds participate are often leaders in their sector of business and hence tend to be more stable when the economies are tumultuous. Large-cap firms often have a proven track record in the market, which is backed up by sound corporate governance.

Midcap Funds

- Mid-Cap Mutual Funds are a type of mutual fund that invests in smaller companies. These funds invest in mid-cap firms’ stock and equity-related products. Mid-cap firms, as per the Securities and Exchange Board of India (SEBI), are those that are classified between 101th to 250th in terms of market capitalization.

- Because mid-cap companies fall between small-cap and large-cap enterprises, they have benefits and drawbacks. Mid-cap funds typically outperform large-cap funds in return, but they are also more unpredictable. They are, on the other hand, more secure than small-cap funds but give lower returns compared to small cap.

- In a nutshell, these funds offer the ideal balance of risk and return. As an owner, you can anticipate significantly better returns if you choose the schemes wisely, with a decent selection of equities, sector diversification, and a skilled fund manager.

Small Cap

- Funds that invest in stocks of smaller-sized companies are called Small-cap funds. Small Cap is a term used to classify companies with a relatively small market capitalization. However, the definition of small cap can vary among market intermediaries, but it is generally regarded as a company with a market capitalization of less than Rs 100 crores. Many small caps are young companies with significant growth potential.

- However, the risk of failure is greater with small-cap stocks than with large-cap and mid-cap stocks. As a result, small-cap stocks tend to be more volatile (and therefore riskier) than large-cap and mid-cap stocks. Historically, small-cap stocks have typically underperformed large-cap stocks during recessions but have outperformed large-cap stocks as the economy has emerged from recessions. The smallest stocks of the small caps are called micro-caps While the opportunity for these companies to experience extreme growth is great, the risk of losing a large amount of money is also possible

Multi Cap Equity Funds or Diversified Equity Funds

- Invests in stocks of companies across the stock market regardless of size and sector. These funds provide the benefit of diversification by investing in companies spread across sectors and market capitalisation. They are generally meant for investors who seek exposure across the market and do not want to be restricted to any particular sector. They invest in companies across different market caps and hence reduce the amount of risk in the fund. Diversification helps prevent events that could affect a single sector from affecting the fund, and hence reduce risk.

Equity Linked Savings Schemes

- They are diversified equity funds with a lock-in period of 3 years, i.e. you will not be able to redeem units of these schemes for three years from the date of investment. If you are investing in ELSS through a Systematic Investment Plan (SIP) then each SIP instalment will be locked in for 3 years. Investments in ELSS of up to Rs 1.5 lakhs are eligible for deduction from your taxable income under Section 80C of the Income Tax Act.

- You can save up to Rs 46,800 (not including surcharge) in taxes by investing in ELSS. Historical data shows that ELSS has the potential to give superior returns in the long term compared to other 80C schemes like Public Provident Fund, National Savings Certificates, Tax Saver Bank FDs, Life insurance policies etc, however since ELSS are market-linked, they carry a higher risk than traditional instruments.

- Equity-linked savings schemes usually follow a multi-cap strategy. The lock-in period works to the advantage of investors because the fund managers have fewer redemption pressures due to the lock-in, and therefore, can stick longer to their high-conviction stocks which have the potential to generate superior returns for investors in the long term. Though ELSS have a lock-in period of 3 years, financial advisors recommend longer investment tenures for these funds since they have the potential to give better results over longer investment horizons.

Sectoral Funds

- A sector fund is a type of investment fund that only engages in businesses in a specific industry or sector of the economy.

- Sector funds invest in companies operating in the fund’s chosen sector to focus on one section of the market, called as a sector. A sector is made up of one or more businesses that sell the same or similar products. The banking and computing sectors are two examples of common sectors. Apple is in the technology industry, whereas JPMorgan is in the banking sector. Sector funds allow investors to make specific bets on a specific sector list’s potential for growth.

Sector funds are broadly divided into the following categories

- Real Estate Funds – allow investors with a limited amount of money to invest in the real estate industry.

- Utility Funds – These funds invest in well-performing utility businesses to provide consistent dividends.

- Natural Resources Funds – These funds invest in companies that are involved in the oil and gas, energy, forestry, and timber industries.

- Technology Funds – These funds give investors access to the tech industry.

- Financial Funds – These are funds that invest largely in companies in the financial sector, such as banks, insurance companies, and accounting firms.

- Communications Funds – These funds specialise in investing in the telecommunications industry, but they frequently incorporate internet-related businesses as well

- Pharmaceutical firms, path lab chains, and other for-profit medical facilities are covered by healthcare funds.

- Precious Metals Funds – These funds provide investors with access to precious metals such as gold, platinum, silver, copper, and mercury.

4. Debt Fund

- A debt fund is a fund that invests in bonds, or other debt securities. They invest in fixed-interest-generating securities such as corporate bonds, government securities, treasury bills, commercial paper, and other money market instruments.

- The main reason for investing in debt funds is to earn a steady interest income and capital value. In total, the fee ratios on debt funds are lower than those attached to equity. A debt fund provides a gentle but low income relative to equity. It is comparatively less volatile.

Benefits of Investing In Debt Fund

- Immune from market volatility: Unlike equity mutual funds, a debt mutual fund is not subject to market circumstances. Investments are made in securities with a fixed maturity period and rate of interest.

- Liquidity: Debt funds are highly liquid and one can get a retrieval amount in a bank account within one day.

- Better Return: One can get decent higher returns than 4% in normal savings bank accounts and normal bank fixed deposits.

- Helps to achieve investment aim: Debt funds have a fixed maturity period and offer low but steady returns. If you have a short-term investment aim for building a corpus for a forthcoming expense, a debt mutual fund is a suitable option.

- Taxation: One distinctive feature of debt funds is that mutual fund companies are not likely to deduct any taxes from their earnings. Tax liability arises when an investor saves units. Besides, he or she can help reach gains against any other long-term or short-term losses.

Risk Associated With Debt Mutual Fund

- Interest Rate Risk–

- Interest rate movement poses a risk to debt MF investors. Interest rates typically rise when the economy is growing, and fall during economic downturns. Bond prices and interest rates are inversely related. When interest rates rise bond prices fall and vice versa. Usually, the longer the maturity, the greater the degree of price volatility. Interest rate risk is present in all debt funds but the degree could vary. Gilt funds with longer maturity, carry higher interest rates.

- This can be reduced by adjusting the maturity of the debt fund portfolio, i.e. the buyer of the debt paper would buy debt paper of lesser maturity so that when the paper matures, he can buy newer paper with higher interest rates. So, if the investor expects interest rates to rise, he would be better off giving short-term loans (when an investor buys a debt paper, he essentially gives a loan to the issuer of the paper). By giving a short-term loan, he would receive his money back in a short period.

- As interest rates would have risen by then, he would be able to give another loan (again short term), this time at the new higher interest rates. Thus in a rising interest rate scenario, the investor can reduce interest rate risk by investing in debt paper of extremely short-term maturity.

- Credit risk-

- The second risk is known as Credit Risk or Risk of Default. It refers to the situation where the borrower fails to honour either one or both of his obligations of paying regular interest and returning the principal on maturity.

- A bigger threat is that the borrower does not repay the principal. This can happen if the borrower turns bankrupt. This risk can be taken care of by investing in paper issued by companies with very high Credit Rating. The probability of a borrower with very high Credit Rating defaulting is far lesser than that of a borrower with low credit rating. Credit rating agencies like CRISIL, ICRA, CARE etc. rate the issuer of the bond on their ability to repay by assessing their overall financial health.

- Credit ratings can change over time. The performance of companies is measured and the risk assessment is done at periodic intervals. The risk that a fund manager is worried about is not the risk of default but the possible downgrade in the credit rating of the debt paper. If a debt paper gets downgraded, the market price of such an instrument also comes down which affects the portfolio directly. On the other hand, if the credit rate gets upgraded the fund would benefit from an increase in its fund value.

- Government paper is the ultimate in safety when it comes to credit risk (hence the description ‘risk-free security’). This is because the Government will never default on its obligations. If the Government does not have cash (similar to a company going bankrupt), it can print more money to meet its obligations or change the tax laws to earn more revenue (neither of which a corporation can do!).

Debt Mutual fund schemes

1. Fixed Maturity Plans

- Fixed Maturity Plan (FMP) is a fixed-tenure mutual fund scheme that invests its corpus in debt instruments maturing in line with the tenure of the scheme. The tenure of an FMP can vary between a few months to a few years.

- The objective of FMPs is to take a call on the interest rate cycle and choose suitable instruments that will yield the best returns to the investors. FMPs are open for investments only during their New Fund Offer (NFO) period and investors can redeem their capital with the income generated only upon the maturity of these funds. However, to provide the element of liquidity, FMPs are listed as tradeable securities on stock exchanges, so that investors have the choice of exiting by selling off their units in the stock exchange.

- FMPs are ideal for investors who are keen to stay invested for the tenure of the scheme and seeking an alternate investment option that aims to provide better post-tax returns with minimal interest rate risk

2. Gilt funds

- Gilt funds are such debt funds that only invest in bonds and fixed interest-bearing securities issued by the state and central governments. These investments are made in instruments having differing maturity. Since the fund is invested with the government, these funds are said to carry negligible risks.

- As per SEBI norms, gilt funds have the mandate to invest at least 80% of their assets in government securities. There are two kinds of gilt funds. One is gilt funds that invest mostly in government securities across maturities. Second, gilt funds with a constant maturity of 10 years these funds must invest at least 80% of their assets in government securities with a maturity of 10 years.

- Whenever the State or Central Government requires funds, it asks the apex bank of the country – The Reserve Bank of India (RBI) – which is also the Government’s banker. RBI collects the required funds from banks and insurance organizations and lends them to the state/central governments. In exchange, the Reserve Bank of India issues g-secs or government securities with a fixed tenure. Gilt Funds subscribe to these securities. Once the security matures, the fund returns it and receives a payout.

- For most conservative investors, Gilt funds are a perfect combination of reasonable returns and minimal risks. However, it is important to note that Gilt Funds are affected by the changes in interest rates.

Benefits of Gilt Fund

- Zero Credit Risk

Unlike mutual funds that invest in corporate bonds where there is always significant credit risk, gilt funds have zero credit risk. This is because the government generally fulfils its obligations. The same is not true in the case of corporate bonds.

- Capital Protection

While no mutual fund offers 100% capital protection, gilt funds are one of the few that carry minimal risk. Investments are made in government-backed securities, and the chances of any significant capital loss are close to none.

- Invest in Securities Not Available to Retail Investors

Most of the government securities are unavailable to retail investors. However institutional investors like fund houses are allowed to subscribe to such securities. So, by investing in gilt funds, you get to invest in such government securities indirectly.

Corporate Bond Funds

invest a minimum of 80% of their corpus in bonds issued by private companies only. Credit rating plays a crucial role here. While they generate decent returns (7%-8%), investors should be careful of concentration risk.

5. Hybrid Fund

- Hybrid funds invest in both debt and equity instruments to achieve diversification and avoid concentration risk. A perfect blend of the two offers higher returns than a regular debt fund while not being as risky as equity funds.

- Hybrid funds aim to achieve wealth appreciation in the long run and generate income in the short run via a balanced portfolio. The fund manager allocates your money in varying proportions in equity and debt based on the investment objective of the fund. The fund manager may buy/sell securities to take advantage of market movements.

Benefits Hybrid Funds

Following are some of the benefits of balanced funds in India:

- Investing in hybrid funds offers investors the chance to diversify their portfolios as these funds invest in a variety of instruments across equity and debt assets.

- Investments made in hybrid funds permit the fund manager to adjust the fund’s portfolio according to market conditions.

- They carry lower risk than pure equity mutual funds.

- These mutual funds are designed to automatically re-balance an investor’s portfolio in the event of extreme market fluctuations. Re-balancing even allows fund managers to sell equity mutual funds to maintain the fund’s performance and vice versa.

- These funds can offer varying levels of risk tolerance ranging from conservative to moderate and aggressive. There are equity-oriented schemes for the risk-taker debt-oriented schemes for the risk-averse and the Dynamic Asset Allocation Fund for those who do not want to stick to a fixed Asset allocation but want to move basic market views without taking the calls themselves. Arbitrage for investors who are looking for stable returns in a volatile environment.

Types Of Hybrid Mutual Fund

1. Equity-Oriented Hybrid Funds

An equity-oriented hybrid fund invests at least 65% of its total assets in equity and equity-related instruments of companies across various market capitalizations and sectors. The remaining 35% is invested in debt securities and money market instruments.

2. Debt-Oriented Hybrid Funds

A debt-oriented hybrid fund invests at least 60% of its total assets in fixed-income securities like bonds, debentures, government securities, etc. The remaining 40% is invested in equity. Some funds also invest a small part of their corpus in liquid schemes.

3. Balanced Funds

These funds invest a minimum of 65% of their total assets in equity and equity-related instruments and the rest in debt securities and cash. For taxation, they are considered to be equity funds and offer tax exemption on long-term capital gains of up to Rs. 1 lakh. The fixed income component makes it a good option for equity investors as it helps mitigate the volatility of equity investments.

4. Dynamic Bond Funds-

These bond Funds invest in debt securities of different maturity profiles. These funds are actively managed and the portfolio varies dynamically according to the interest rate view of the fund managers. Such funds give the Fund Manager the flexibility to invest in short- or long-term instruments based on his view on the interest rate movement. Dynamic Bond Funds follow an active portfolio duration management approach by keeping a close watch on various domestic and global macro-economic variables and interest rate outlook

5. Monthly income plan

Monthly Income Plans, known as MIPs, are debt-oriented hybrid mutual funds that give a fixed return every month to the investor. The ratio of equity investments is considerably low but is just enough to give you an added advantage to the stability of the debt part of the fund. The returns are given out in the form of dividends, and the frequency of payouts will depend on the fund and the investor, it could be monthly, quarterly, half-yearly or annual.

MIPs, like fixed-income funds, invest in instruments such as government securities, commercial paper, treasury bills and certificates of deposits. A MIP has to be distinguished from a Monthly Income Scheme (MIS) offered by banks and post offices, which is a type of term deposit plan that offers you small but steady returns until maturity.

The following are the main features of a Monthly Income Plan:

- The plan consists of 15-25% equity stocks and the rest 75-85% is invested in debt funds. This way, you can combine the profitability of stock markets with the stability of debt instruments.

- MIPs come in growth and income options. The growth option works like an equity fund and does not give you regular income, while the income option gives periodic dividend payouts.

- You can choose the equity weightage of your MIP. There are 2 main kinds of plans Aggressive, with up to 30% equity investments, and MIP conservative, with 15% or less equity portion.

- MIPs give higher returns in the 1-to3-year tenure than traditional savings instruments such as fixed deposits, but the risk is higher due to the presence of the equity component.

The objective of these schemes is to provide regular income to the investor by paying dividends; however, there is no guarantee that these schemes will pay dividends every month. Investment in the debt portion provides for the monthly income whereas investment in the equities provides for the extra return which helps minimize the impact of inflation.

6. Child Benefit Plans

- These are debt-oriented funds, with very little component invested into equities. The objective here is capital protection and steady appreciation as well. Parents can invest in these schemes with a 5 – 15-year horizon so that they have adequate money when their children need it for meeting expenses related to higher education.

7. Capital Protection Funds

- A mutual fund, categorized under closed-hybrid funds, oriented towards protecting your capital from any market risk with a balanced exposure to both equities and debt is known as Capital Protection Fund. Their portfolio is largely inclined towards debt securities. It invests the majority of its assets in highly rated bonds, T-Bills, certificates of deposits and other fixed-income financial vehicles that give assured returns at maturity.

- These funds aim to mitigate risks arising out of economic downturns by focusing predominantly on fixed-income securities and debt. This ensures that an investor’s investment remains protected in addition to being appreciated every year.

- The accrued resources from investors are allocated to equities and debt securities. Around 80-90% of assets are invested in debt, while the remaining is allocated to equities. The amount invested in debt ensures that the principal investment of the investor is recovered at maturity. While the amount invested in equities generates returns for the investor which are generally better than those from Bank Fixed Deposits.

Characteristics

- Guaranteed/Protected principal. Most principal-protected funds guarantee the initial investment minus any front-end sales charge even if the stock markets fall.

- Lock-up period. The guarantee does not apply if the investor sells any units in the fund before the end of the “guarantee period”.

- Hold a mixture of bonds and stocks. Most principal-protected funds invest a portion of the fund in zero-coupon bonds and other debt securities, and a portion in equity investments.

6. Factors To Be Considered While Choosing A Mutual Fund Scheme

Time Horizon

- The time horizon is the period for which the investment is to be made. The period could range from 1 day to as much as more than 5 years. For the long term, equity should be chosen and short-term debt instruments should be chosen

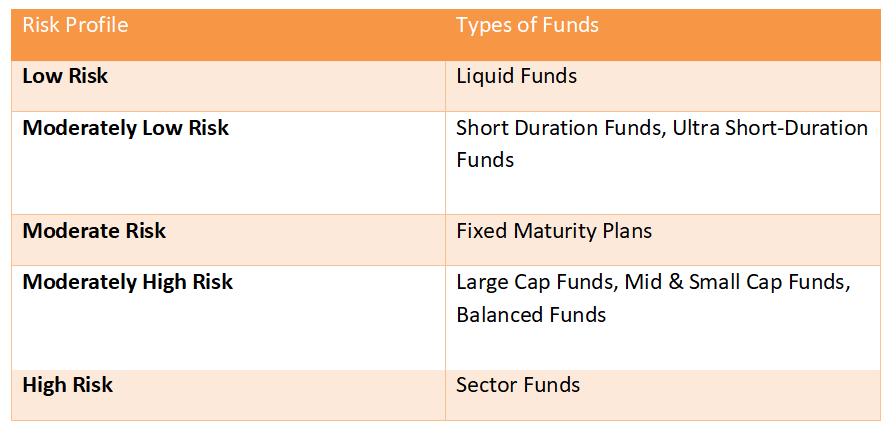

Risk Tolerance

- For a risk-taking investor, a volatile fund like a small-cap fund can be chosen and for a risk-adverse investor, a large-cap fund may be chosen. The best and quickest way to identify the risk appetite that the mutual fund serves is by looking at its risk-o-meter.

- A risk-o-meter is a graphical representation of the risk involved in a mutual fund.

- It helps the prospective investor to understand if the risk level of the mutual fund scheme matches with that of his own.

It contains 5 levels of risks –

- Low

- Moderately low

- Moderate

- Moderately high and

- High

Performance Against Category

- Another way to find the best mutual fund is to compare its performance against the other schemes in that category. It should be remembered that a comparison must be made between the schemes of the same category. For instance, a large-cap fund must be compared with other large-cap funds and not with small or mid-cap funds.

Consistency of Performance

- A mutual fund should generate good returns for its investors regularly and not just a one-off good performance. We should look for a fund that provides decent returns in both bull and bear markets.

Fund Manager Experience

- The educational qualification and the duration for which the fund manager has been managing that fund should be considered. His record should be tracked as well

Expense Ratio

- This reflects the fee which is charged by an AMC for the fund management and other costs related to the fund.

- Naturally, the investor should choose a fund that has a lower expense ratio compared to other funds provided the returns are consistent.

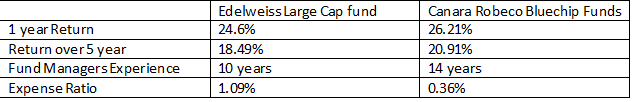

Example- Let’s suppose you have an option of investing Rs. 50,000 in a fund and want to decide which mutual fund to invest in. The first question is whether you want to invest in the long term or the short term- ‘Let you choose the long term- and then we would go about investing in an Equity Fund. Now within the Equity fund- Are you a person who likes taking a very high risk- if not then we would go ahead and invest in a large-cap fund. Once this decision is done- let’s now select the right fund for the investment.

From the above table, it can be seen that Canara Robeco performs better than Edelweiss on all parameters. The expense ratio is lower and returns both in 1 year and longer tenure is higher than the Edelweiss fund.

7. Risk Factors In Mutual Fund Schemes

- In a mutual fund scheme, an investor has to understand the various elements of their

- investment that are susceptible to risk. Such elements are known as risk factors, and there are two types of risk factors in a mutual fund

Standard Risk Factors:

The basic examples of such factors are included in some statements that are issued by AMCs in their advertisements of mutual fund schemes.

Some of these statements include-

- Investment in mutual fund units involves investment risks such as trading volumes,

- settlement risks, liquidity risks, and default risks including the possible loss of principal.

- As the price, value, and interest rates of the securities in which the scheme invests fluctuate, the value of the investment may go up or down.

- Mutual funds are subject to market risks and there is no guarantee that the Fund’s objective will be achieved.

- Past performance is not a guarantee of future performance.

- The name of the scheme does not indicate either the quality or its prospects and returns

Scheme-Specific Risk Factors

These risks are specific to a scheme, ii. e…; they do not apply to all mutual fund schemes.

Examples of scheme-specific risks are:

- The risk arising from the investment objective of the scheme;

- The risk arising from the investment strategy of the scheme;

- The risk arising from the asset allocation of the scheme; and

- The risk arising from any non-diversification in the scheme

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.