Intraday trading, also called day trading, is the buying and selling of stocks and other financial instruments within the same day. In other words, intraday trading means all positions are squared-off before the market closes and there is no change in ownership of shares as a result of the trades.

Day traders should select stocks that have ample liquidity, mid to high volatility, and group followers. Identifying the right stocks for intraday trading involves isolating the current market trend from any surrounding noise and then capitalizing on that trend.

Tips to Choose the Right Intraday Trading Stocks:

- Trade Only in Liquid Stocks.

- Stay Away from Volatile Stocks.

- Trade in Good Correlation Stocks.

- Follow the Market Trend before deciding the Right Stock.

- Pick the Stock you are most confident in after Research.

Trade Only in Liquid Stocks

Liquidity is the most important intraday trading tip while choosing the right stocks to trade during the day. Liquid stocks have huge trading volumes whereby larger quantities can be purchased and sold without significantly affecting the price. Generally, lesser liquid stocks do not provide traders the opportunity to purchase and sell larger quantities due to lack of too many buyers. Some traders may argue that illiquid stocks offer bigger opportunities with rapid price modifications. However, statistics show that volatile stocks show greater movements in a short period of time. Thus, most of the possible gains dissipate while the downside risk still looms. Nonetheless, the liquidity of the stocks depends on the quality of the trades placed by the traders. For example, a volume of 50,000 to 75,000 shares is sufficient if the trade is for 50 or 100 Rs; however, if the volume is a few hundred or thousands, volume requirements significantly become larger.

While selecting liquid stocks, don’t forget to check liquidity at various price levels. You will find some stocks that are highly liquid at a lower price level, but the volume drops drastically after reaching a certain price zone. Understanding the variability of liquidity at different price levels will help you buy these stocks at the right time.

Stay Away from Volatile Stocks

It is commonly noticed that a low daily volume of traded stocks or those where some huge news is expected to move in an unpredictable way. Sometimes, the stock may show volatility even after the announcement of the big news. Traders are recommended to avoid intraday trading in such stocks. A few volatile stocks are in the mid-size segment while most stocks traded in the low-cap categories like S, T, and Z are highly chaotic. In addition to being volatile, these stocks have low daily volumes, making them illiquid.

Keeping the above warning in mind, let’s now also tell that a certain degree of volatility indicates active market and intraday traders can profit by successfully betting in these stocks. Although there is no rule, most intraday traders acknowledge shares with 3-5 percent of price movement on either side as the best intraday stocks.

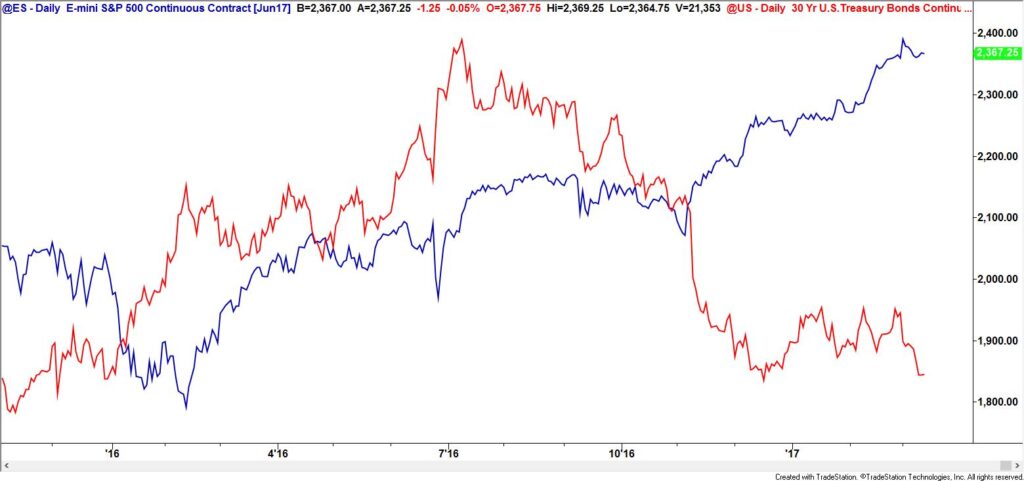

Trade in Good Correlation Stocks

An intraday tip for choosing the right stock is to opt for those that have a higher correlation with major sectors and indices. This means when the index or the sector sees an upward movement, the stock price also increases. Stocks that move according to the sentiment of the group are reliable and often follow the expected movement of the sector. For example, strengthening of the Indian Rupee against the Dollar will generally affect all information technology companies dependent on the US markets. A stronger rupee implies lower earnings for the IT companies and weakening rupee will result in higher export incomes for these companies.

Follow the Trend

One of the most important intraday trading tips is to remember that moving with the trend is always beneficial. During a bull run in the stock market, traders must try to identify stocks that can potentially arise. On the other hand, during the bear run, finding stocks that are likely to decline is advisable.

Pick after Research

Undertaking quality research is one of the most vital intraday tips that traders must always remember. Unfortunately, most day traders avoid doing their research. Identifying the index and then finding sectors that are of interest is recommended. The next step is to create a list of several stocks with these sectors. Traders need not necessarily include sector leaders, but rather identify stocks that are liquid. Technical analysis and determining the support and resistance levels along with studying the fundamentals of these stocks will help traders find the right stocks to profit through intraday/day trading.

Intraday trading has inherent risks, but speed plays a vital role in making all the difference. Earning profits through small price fluctuations during the few trading hours is not an easy task. Intraday trading is all about initiating and closing out your trades on the same day. For example, if you buy 500 shares in the morning at Rs.920 and sell it by an evening at Rs.928, then you can book a profit of Rs.4000 (500×8) intraday. This trade does not result in any delivery as your net position at the end of the day is zero. You can also sell the stock in the morning and buy it back in the evening if you believe that the stock is likely to go down. In fact, if you want to short sell stocks (without delivery), then the only way you can do it in rolling settlements mode is intraday.

The most important step for an intraday trader is selecting the stocks to trade intraday. You need stocks that can give movement and at the same time are predictable.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.