A mutual fund is a company that brings together money from many people and invests it in stocks, bonds or other assets. The combined holdings of stocks, bonds or other assets the fund owns are known as its portfolio. Each investor in the fund owns shares, which represent a part of these holdings.

Mutual fund investments are becoming very popular with individual investors because of the benefits they provide. The most important factors that drive investors to mutual funds are that Investors can

- Start with any amount (as low as 500)

- Diversify across multiple stocks

- Start Systematic Investment Plan (SIP)

- Invest without DMAT account

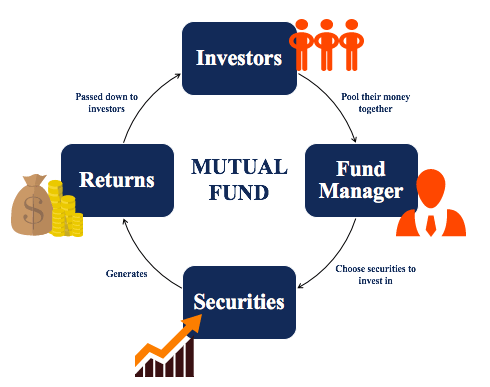

How do Mutual Funds work?

A mutual fund is formed when an asset management company (AMC) pools investments from various individual and institutional investors with common investment objectives. A fund manager professionally manages the pooled investment by strategically investing in capital assets to generate maximum returns for the investors. Fund managers are professionals in the field of finance with an excellent track record of managing investments and have an in-depth understanding of markets. The fund houses charge expense ratio, which is the annual maintenance fee to manage investments of individuals. The investors make money through regular dividends/interest and capital gains. They can either choose to reinvest the capital gains via a growth option or earn a steady income by way of a dividend option.

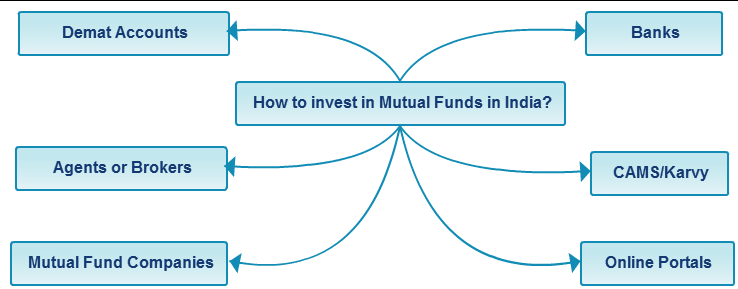

Ways to invest in Mutual Funds

There are different ways in which mutual fund investments can be made. They are:

Offline investment directly with the fund house

You can invest in schemes of a mutual fund by visiting the nearest branch office of the fund house. Just ensure that you carry a copy of the Proof of Address, Proof of Identity, Cancelled Cheque Leaf, Passport Size photograph. The fund house will provide you with an application form which you will need to fill and submit, along with the necessary documents.

Offline investment through a broker

A mutual fund broker or a distributor is someone who will help you through the entire process of investment. He will provide you with all the information you need to make your investment including the features of various schemes, documents needed, etc. He will also offer guidance on which schemes you should invest in. For this, he will charge you a fee which will be deducted from the total investment amount.

Online through the official website

Most fund houses these days offer the online facility of investing in mutual funds. All you need to do is follow the instructions provided on the official site of the fund house, fill the relevant information, and submit it. The KYC process can also be completed online (e-KYC) for which you will need to enter your Aadhar number and PAN. The information will be verified at the backend and once the verification is done, you can start investing. The online process of investing in mutual funds is easy, quick, and hassle-free and hence, is preferred by most investors.

Through an app (Most Preferred tool)

Many fund houses allow investors to make investments through an app which can be downloaded on your mobile device. The app will allow investors to invest in mutual fund schemes, buy or sell units, view account statements, and check other details concerning your folio. Some of the fund houses that allow investments through an app are SBI Mutual Fund, Axis Mutual Fund, ICICI Prudential Mutual Fund, Aditya Birla SunLife Mutual Funds, and HDFC Mutual Funds. Some apps like myCAMS and Karvy allow investors to invest as well as access the details of all their investments from multiple fund houses, on one platform.

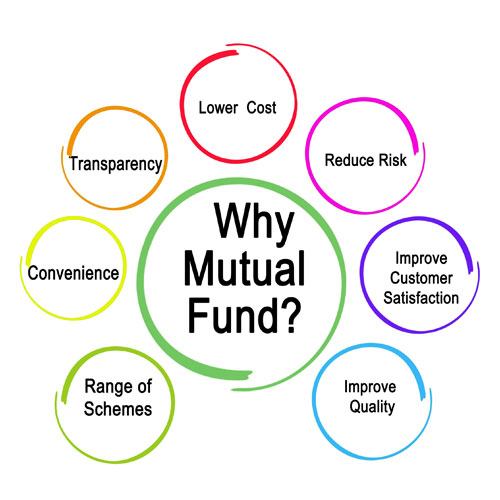

Why should you invest in Mutual Funds?

Mutual funds are professionally managed investment vehicles that will compound your money over a long term. Mutual funds may invest in a variety of instruments like equity, debt, money market, etc., and fetch favourable returns on your investment. There are more reasons why you should invest in mutual funds and we have picked the top ones for you below:

Professional management

Mutual funds are managed by professional fund managers who research and keep a track of the markets, identify the rights stocks, and buy and sell them at an appropriate time so as to generate favourable returns on your investment. Fund managers also analyse the performance of firms before they decide to invest in their stocks. Also, when you buy units of a mutual fund scheme, the scheme information document (SID) will have the professional summary of the fund manager which includes the number of years of work experience, the kind of funds managed, and the performance of the funds managed by him/her. So, you can be rest assured that your money is in the right hands.

Higher returns

Compared to term deposits such as Fixed Deposits (FDs), Recurring Deposits (RDs), etc., mutual funds offer better returns on your investments by investing in a variety of instruments. Equity mutual funds present an excellent opportunity to investors to enjoy higher returns but at the same time are accompanied with high risks and hence, are ideal for investors with a high risk appetite. Debt funds, on the other hand, offer lower risk and fetch better returns than term deposits.

Diversification

Perhaps one of the greatest benefits that mutual funds offer is diversification. By investing in a wide range of asset classes and stocks, mutual funds reduce the risk by diversifying the portfolio. Therefore, even if one asset/stock is not performing well, the performance of other assets can balance it out and you can still enjoy favourable returns on your investment. To reduce the risk further, you can diversify your portfolio by investing in different kinds of mutual funds. Seek the help of a financial advisor if you are not sure about which funds to invest in and how to diversify or balance your portfolio.

Convenience

Investing in mutual funds has been made quick, hassle-free, and simple by many fund houses who offer the online facility of investing. Just by clicking a few buttons, you can start investing in a mutual fund scheme of your choice. Even the KYC process can now be done online and investors can invest up to Rs.50,000 using the e-KYC facility. However, for investments above Rs.50,000, investors are required to complete the physical KYC process.

Low cost

You can start investing in a mutual fund for as low as Rs.5,000 (lump sum) and Rs.500 for a monthly SIP (Systematic Investment Plan). Therefore, you do not have to wait to accumulate a large sum in order to start investing. Also, if you invest in a Direct Plan of a mutual fund scheme, you do not have to pay any additional commission to distributors or agents.

Disciplined investing

To cultivate a habit of regular investing, mutual funds offer a facility known as a Systematic Investment Plan (SIP). An SIP allows investors to invest small amounts regularly, the frequency of which can be weekly, monthly, or quarterly. An auto-debit facility can be set up for your SIP where a fixed sum will automatically be debited from your bank account every month. An SIP offers an excellent way to invest regularly and without having to manually invest each time.Now that you know about the benefits of investing in mutual funds and how to invest in them, start investing and see your wealth grow.

Things to consider before investing in Mutual Funds

Keep KYC documents updated

You cannot invest in a mutual fund if you have not undergone the Know Your Customer (KYC) process yet. KYC is a government regulation for most financial transactions in India. To become KYC-compliant, you need a PAN card and valid address proof.

Open a Net Banking Account

To invest in mutual funds, you will need to activate internet banking on your bank account. Mutual funds also allow investments to be made through debit cards and cheques, but doing it via net banking is a more straightforward and secure process to make investments.

Fix an investment goal

Defining your financial goals, budget, and tenure plays a significant role in your investments. Doing this will help you decide how much you can set aside towards investing and evaluating your risk profile. Investment always works best when done with a purpose.

Choose the right fund type

It takes more than reading about different mutual fund types to decide on the right category. Experts typically recommend a balanced or debt fund for first-time investors as it comes with minimal risks while providing higher returns.

Shortlist and choose one mutual fund

With a plenty of mutual fund schemes in each category, you need to analyse and compare them to pick the right one. Investors should not ignore factors such as the fund manager’s credentials, expense ratio, portfolio components, and assets under management.

Diversify your portfolio

Consider investing in more than one mutual fund. A portfolio of funds will help you diversify across instruments and investment styles. It will also even out risks – when one fund underperforms, the other makes up for the loss without bringing down the worth of your entire portfolio.

Go for SIPs instead of lump-sum investments

Investing via systematic investment plans (SIP) is advisable for those investing in equity instruments for the first time. While a lump sum investment can put you at the risk of catching a market peak, a SIP allows you to spread your investments over time and invest at different market levels. The benefit of rupee cost averaging that comes with SIPs also helps in earning higher returns over the long-term.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.