Most rewarding credit cards in India

A credit card is a convenient financial product that can be used for everyday purchases such as Bill Payments, gas, groceries, and other goods and services. It can also be a great resource for purchasing big-ticket items such as TVs, travel packages, and jewellery because the funds for these items are may not always be available with us.

Advantages of credit cards include:

- Opportunity to build credit

- Earn rewards such as cash back or miles points

- Free credit score information

- No foreign transaction fees

- Increased purchasing power

- Not linked to checking or savings account

- Putting a hold on a rental car or hotel room

- Protection against credit card fraud

It is very difficult to pick the right credit card from plenty of options as almost all banks offer a number of cards with varied features and benefits. So, if you are wondering which credit card is best for you, here we have listed the top 10 best credit cards in India that would be useful in your search for the right credit card.

| S.No. | Top 10 credit cards | Annual fee | Benefits | Minimum Income required |

| 1 | Amazon Pay ICICI Credit Card | Nil | Online Shopping & Cashback | Communicated at the time of sourcing |

| 2 | Axis Bank Ace Credit Card | 499 | Cashback | Communicated at the time of sourcing |

| 3 | SBI SimplyCLICK Credit Card | 499 | Rewards | 20000 |

| 4 | HSBC Cashback Credit Card | 750 | Online Shopping | 33333 |

| 5 | Standard Chartered Super Value Titanium Credit Card | 750 | Shopping & Fuel | 55000 |

| 6 | IndianOil Citibank® Platinum Credit Card | 1,000 | Fuel | 70000 |

| 7 | YES FIRST Preferred Credit Card | 2,499 | Shopping & Travel | 150000 |

| 8 | HDFC Regalia Credit Card | 2,500 | Travel & Shopping | 70000 |

| 9 | Citi PremierMiles Credit Card | 3,000 | Air Miles | 25000 |

| 10 | SBI Card Elite | 4,999 | Travel & Movies | 60000 |

Amazon Pay ICICI Credit Card

When it comes to co-branded benefits, Amazon Pay ICICI Card is one of the best credit cards in India. If you shop at Amazon frequently, you can save big on all your Amazon spends in the form of cashback. Apart from Amazon purchases, you get cashback on other spends as well. The best thing about this credit card is that you get all these benefits free of cost as there is no joining fee or renewal fee on this card.

Features:

- Annual Fee: Nil

- Renewal Fee: Nil

- 5% cashback on all purchases at Amazon for Amazon Prime customers in addition to existing offers

- 3% cashback on all purchases for Non-prime customers

- 2% cashback on purchases at Amazon partners and gift card purchases

- 2% Reward Points on recharges, bill payments, etc.

- 1% cashback on all other purchases

- 1% fuel surcharge waiver on all petrol pumps across India

- 1 Reward Point = 1 Rupee

- No cost EMI on all purchases above Rs. 3,000 for 3 or 6 months

- Additional cash back for Prime as well as non-Prime members as Amazon Pay balance

- Reward points are automatically converted into Amazon Pay balance and credited to the Amazon account as Amazon Pay balance

Axis Bank Ace credit card

Axis Bank Ace Credit Card is one of the best cashback credit cards in India as it comes with the highest universal cashback rate of 2%. If you are not sure about the categories where you spend the most, a cashback credit card would be the right choice for you. Here are the top features of Axis Ace Credit Card.

Features:

- Joining Fee: Rs. 499 (Reversed on spending Rs. 10,000 in the first 45 days)

- Renewal Fee: Rs. 499 (Reversed on spending Rs. 2 Lakh or more in the preceding year)

- Minimum Income: Communicated at the time of sourcing

- 5% cashback on bill payments and mobile recharges through Google Pay

- 4% cashback on Swiggy, Zomato and Ola

- 2% cashback on all other spends

- No maximum limit on the cashback earned

- 5% cashback on Big Basket and Grofers (Valid till 31st December)

- 4 complimentary lounge visits every calendar year

- 1% fuel surcharge waiver for transactions between Rs. 400 and Rs. 4,000; maximum waiver of Rs. 500 in a month

SBI SimplyCLICK Credit Card

If you want to make maximum benefit out of your online spends then SimplyCLICK SBI Card is one of the best cards that you can opt for. It gives you up to 10X reward points along with discount offers on your online spends, which makes it most suitable for shopaholics. Features: 1. Annual Fee: Rs. 499 + GST 2. Renewal Fee: Rs. 499 + GST 3. Minimum Income Required: Rs. 20,000 per month 4. Get Rs. 500 gift voucher as the welcome gift 5 Earn 1 Reward Point on every Rs. 100 spent on the card 6. Get 5X Rewards on all online spends and 10X Rewards on making online spends with exclusive partners of SBI Card 7. Enjoy 1% fuel surcharge waiver on fuel transactions worth Rs. 500 to Rs. 3,000 subject to a maximum waiver of Rs. 100 per billing cycle 8. Spend Rs. 1 Lakh in a year and get the annual fee of Rs. 499 reversed 9. Take benefit of the contactless feature and make payment by just waving the card in front of a POS terminal

HSBC Cashback Credit Card

If you are a frequent shopper and like to make purchases every now and then, you should get a shopping credit card that gives you back in the form of cashback. HSBC Cashback credit card is one such card that offers cashback on all your purchases. Let us have a look at some of the features of this credit card:

Features:

- Joining Fee: Nil

- Renewal Fee: Rs. 750 + GST (Waived off on spending Rs. 1 Lakh in the previous year)

- Minimum Income Required: Rs. 4,00,000 PA

- 2 domestic or international airport lounge access or 2 airport meal vouchers worth Rs. 400 each and Swiggy voucher of Rs. 250 as welcome benefits

- 1.5% cashback on all online spends except wallet transactions

- 1% cashback on all other spends

- Zero joining fee

- Cashback is also applicable on EMIs (Equated Monthly Installments)

- Up to 15% discount on dining at partner restaurants

- Option to pay credit card dues in EMIs on balance transfer, Cash-on-EMI, Loan-on-phone, etc.

- Partner offers from time to time on Big Basket, Amazon Pantry, MakeMyTrip, etc.

- Zero lost card liability, emergency card replacement, global card access, cash advance, etc.

Standard Chartered Super Value Titanium Credit Card

Standard Chartered Super Value Titanium credit card is designed especially for those who like to get something in return every time they use their credit card. You get cashback and rewards on all spends. This is one of those cards that offer cashback on fuel spends as well. Let us talk more about this card below:

Features:

- Annual Fee: Rs. 750 + GST

- Renewal Fee: Rs. 750 + GST

- Minimum Income Required: Rs. 55,000 per month

- 5% cashback on fuel spends, phone recharges and utility bill payments

- 1 Reward point on every Rs. 150 spent across all other categores

- Complimentary Priority Pass Membership

- Offers and discounts on shopping, travel booking, dining, etc. under Standard Chartered Good Life programme

- Standard Chartered 360° Rewards Program for rewards redemption

- Credit card balance transfer up to Rs. 5 Lakh from other cards at lower interest rate

- Lifetime free add-on credit cards for family (spouse, children above 18 years of age, siblings and parents)

IndianOil Citibank® Platinum Credit Card

If you are concerned about the rising fuel costs and are on an active lookout for ways to save on it, then IndianOil Citibank Platinum Credit Card is what you should consider. This is one of the best credit cards for fuel and features in top 10 credit cards in 2020. Here are some of its benefits:

Features:

- Annual Fee: Rs. 1,000 + GST

- Renewal Fee: Rs. 1,000 + GST (waived off on spending Rs. 30,000 or more)

- Minimum Income Required: Rs. 25,000 per monthGet up to 71 litres of free fuel every year in the form of fuel surcharge waiver and turbo points

- Earn 4 Turbo Points on every Rs. 150 spent on authorized Indian Oil Retail Outlets across the country

- Get 2 Turbo Points per Rs. 150 on grocery and supermarket spends and 1 Turbo Point on all other spends

- Accumulated Turbo Points never expire

- Avail the exclusive concierge service by Citi Bank through which you can get various types of assistance on a call

- Make payments by waving the card in front of a POS as this is a contactless card

- Enjoy up to 15% off on dining spends at partner restaurants of Citi Bank

YES FIRST Preferred Credit Card

YES FIRST Preferred Credit Card is a premium card well-suited to the needs of frequent travellers and shoppers. The card also offers generous rewards with every purchase which can later be redeemed to get vouchers, merchandise or Intermiles. Here are some key highlights of this YES Bank credit card:

Features:

- Annual Fee: Rs. 2,499

- Renewal Fee: Rs. 2,499

- Minimum Income Required: Rs. 1,50,000 per monthWelcome gift of 10,000 reward points on making the first purchase within 90 days of card activation

- Get renewal benefit of 7,500 reward points every year on the payment of renewal fee

- Earn 8 reward points per Rs. 200 across all categories

- Earn 2X rewards on Travel Agencies & Tour Operators, Domestic Airlines and Dining

- Redeem rewards to buy products from an exclusive catalogue or to book flight/hotel/movie tickets from YES Bank’s dedicated website (1 Reward Point = Re. 0.25)

- Covert reward points into Intermiles in 4:1 ratio

- Get exclusive golf benefits under Mastercard World Golf Programme; get waiver of 3 green fees at select golf courses and 1 complimentary lesson per month

- Enjoy complimentary Priority Pass Membership along with 4 free visits in a year

- Avail dedicated concierge service and automobile assistance via YES ASSIST

- Enjoy a preferential foreign exchange markup fee of 1.75% only

- Enjoy 25% off on movie ticket booked through BookMyShow

- Get complimentary insurance covers including life cover, medical insurance and credit shield cover

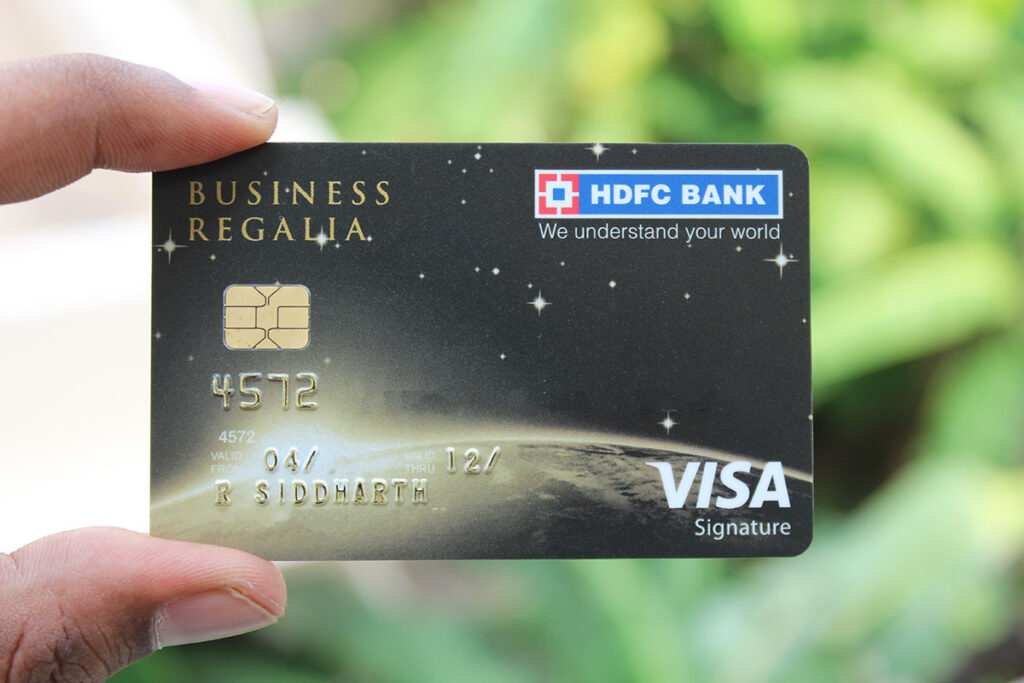

HDFC Regalia Credit Card

If you are looking for a credit card that offers something for every category, HDFC Regalia should be your first choice. It offers discounts on dining, offers on travel, has a good rewards program and a comprehensive protection plan. Let us find out more about HDFC Regalia credit card:

Features:

- Annual Fee: Rs. 2,500 + GST

- Renewal Fee: Rs. 2,500 + GST (waived off on spending Rs. 3 Lakh in the previous calendar year)

- Minimum Income Required: Rs. 70,000 per monthZomato Gold Membership for a year on spending Rs. 75,000 within first 3 months of issuance of the credit card

- 2,500 Reward Points on payment of the joining fee and renewal fee every year

- 12 complimentary domestic airport lounge access every calendar year

- Up to 12 international lounge access every year for self and add-on member under Priority Pass Membership that can be activated on doing 4 retail transactions

- 24×7 travel concierge service for booking, travel, late-night deliveries, etc.

- Priority dining facility under Good Food Trail dining program at top restaurants across the country

- 4 Reward Points every Rs. 150 spent on all retail spends including utility bills, insurance, education, rent, etc.

- 10,000 Reward Points on spending Rs. 5 Lakh on the card and additional 5,000 points on reaching the milestone spends of Rs. 8 Lakh

- 1% fuel surcharge waiver on all transactions between Rs. 400 and Rs. 5,000 at all petrol pumps in the country

- Rewards redemption on flight and hotel booking, vouchers, gifts and products, etc. with 70% redemption of ticket fare for flight and hotel

- Air accidental death cover of Rs. 1 crore

- Emergency overseas hospitalization cover of up to Rs. 15 Lakh

Citi PremierMiles Credit Card

Those who don’t mind shelling some money on their credit card fee in exchange for exclusive travel benefits like air miles on every spend, lounge access, discounts and other travel deals can apply for Citi PremierMiles Credit Card which is one of the top travel credit cards in India.

Features:

- Annual Fee: Rs. 3,000 + GST

- Renewal Fee: Rs. 3,000 + GST

- Minimum Income Required: Rs. 25,000 per monthSpend Rs. 1,000 or more within 60 days of card issuance and get 10,000 Bonus Miles

- Get additional 3,000 Miles on card renewal

- Earn 4 Miles for every Rs. 100 spent across all categories

- Earn 10 Miles for every Rs. 100 on transactions made with any airline in the world

- The accumulated air miles never expire

- Get complimentary access to airport lounges in India and across the globe

- Transfer Miles to the Frequent Flyer Programs of different airline partners in 2:1 ratio

SBI Card Elite

SBI Card Elite is a perfect companion to your elite lifestyle as it comes with exclusive shopping vouchers from some premium brands as welcome gift along with movie tickets benefit, accelerated reward points, complimentary lounge visits, club Vistara membership and more. Some benefits of this top credit card for 2020 are as follows:

Features:

- Annual Fee: Rs. 4,999 + GST

- Renewal Fee: Rs. 4,999 + GST

- Minimum Income Required: Rs. 60,000 per monthGet welcome e-gift voucher worth Rs. 5,000 from Yatra, Bata/Hush Puppies, Pantaloons, Shoppers Stop and Marks & Spencer

- Get free movie ticket worth Rs. 6,000 in a year in the form of Rs. 250 vouchers in a month

- On reaching annual spends of Rs. 3 Lakh and 4 Lakh, get 10,000 bonus reward points

- Earn 2 Reward Points per Rs. 100 on all categories except fuel

- Accelerate your reward earnings 5 times when using the credit card for grocery, dining and departmental store purchases

- Get access to over 1,000 airport lounges across the globe with a complimentary Priority Pass Membership

- Get 6 complimentary international airport lounge visits in a year subject to maximum 2 visits per quarter and 2 complimentary domestic lounge visits

- Enjoy complimentary Club Vistara Membership

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.