A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.

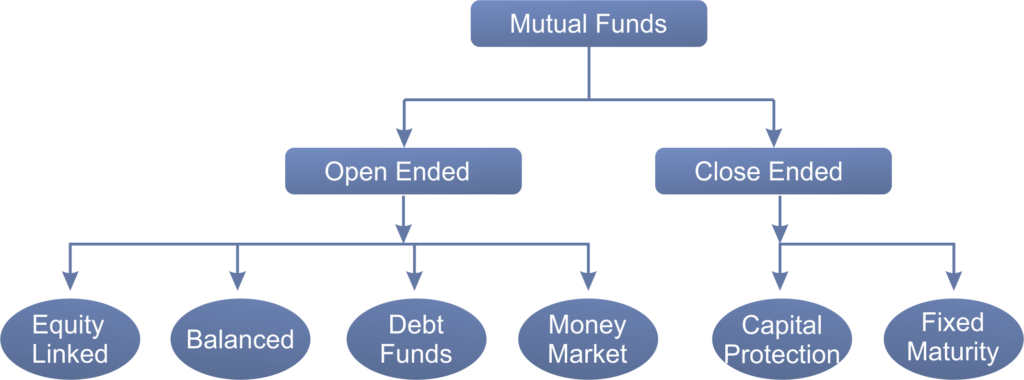

Mutual funds are divided into several kinds of categories, representing the kinds of securities they have targeted for their portfolios and the type of returns they seek. There is a fund for nearly every type of investor or investment approach. Other common types of mutual funds include money market funds, sector funds, alternative funds, smart-beta funds, target-date funds, and even funds of funds, or mutual funds that buy shares of other mutual funds.

Equity funds

These funds invest in stocks. These funds aim to grow faster than money market or fixed income funds, so there is usually a higher risk that you could lose money. You can choose from different types of equity funds including those that specialise in growth stocks (which don’t usually pay dividends), income funds (which hold stocks that pay large dividends), value stocks, large-cap stocks, mid-cap stocks, small-cap stocks, or combinations of these.

Money market funds

These funds invest in short-term fixed income securities such as government bonds, treasury bills, bankers’ acceptances, commercial paper and certificates of deposit. They are generally a safer investment, but with a lower potential return other types of mutual funds.

Fixed income funds

These funds buy investments that pay a fixed rate of return like government bonds, investment-grade corporate bonds and high-yield corporate bonds. They aim to have money coming into the fund on a regular basis, mostly through interest that the fund earns. High-yield corporate bond funds are generally riskier than funds that hold government and investment-grade bonds.

Balanced funds

These funds invest in a mix of equities and fixed income securities. They try to balance the aim of achieving higher returns against the risk of losing money. Most of these funds follow a formula to split money among the different types of investments. They tend to have more risk than fixed income funds, but less risk than pure equity funds. Aggressive funds hold more equities and fewer bonds, while conservative funds hold fewer equities relative to bonds.

Index funds

These funds aim to track the performance of a specific index such as the S&P/TSX Composite Index. The value of the mutual fund will go up or down as the index goes up or down. Index funds typically have lower costs than actively managed mutual funds because the portfolio manager doesn’t have to do as much research or make as many investment decisions.

ACTIVE VS PASSIVE MANAGEMENT

Active management means that the portfolio manager buys and sells investments, attempting to outperform the return of the overall market or another identified benchmark. Passive management involves buying a portfolio of securities designed to track the performance of a benchmark index. The fund’s holdings are only adjusted if there is an adjustment in the components of the index.

Specialty funds

These funds focus on specialized mandates such as real estate, commodities or socially responsible investing. For example, a socially responsible fund may invest in companies that support environmental stewardship, human rights and diversity, and may avoid companies involved in alcohol, tobacco, gambling, weapons and the military.

Fund-of-funds

These funds invest in other funds. Similar to balanced funds, they try to make asset allocation and diversification easier for the investor. The MER for fund-of-funds tend to be higher than stand-alone mutual funds. The Management Expense Ratio (MER) represents the combined total of the management fee, operating expenses and taxes charged to a fund during a given year expressed as a percentage of a fund’s average net assets for that year. All mutual funds have an MER.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.