Profit margins determine how much money you are making and represent the overall financial health of your business.

- Businesses need to pay attention to profit margins to remain fiscally healthy.

- Profit margins measure how well a company is doing.

- A business owner should always know how their organization is spending money so they can optimize profits.

- This article is for business owners and entrepreneurs who want to understand profit margins and how they can make their company become more successful using them.

It’s important to know what your profit margins are and track them at all times. Your business needs to make money to keep afloat, and monitoring your profit margins helps you know the health of your business and tells you if your company can grow. Whether you’re a well-established company or a startup working out of a garage, you should understand your profit margins.

What is a profit margin?

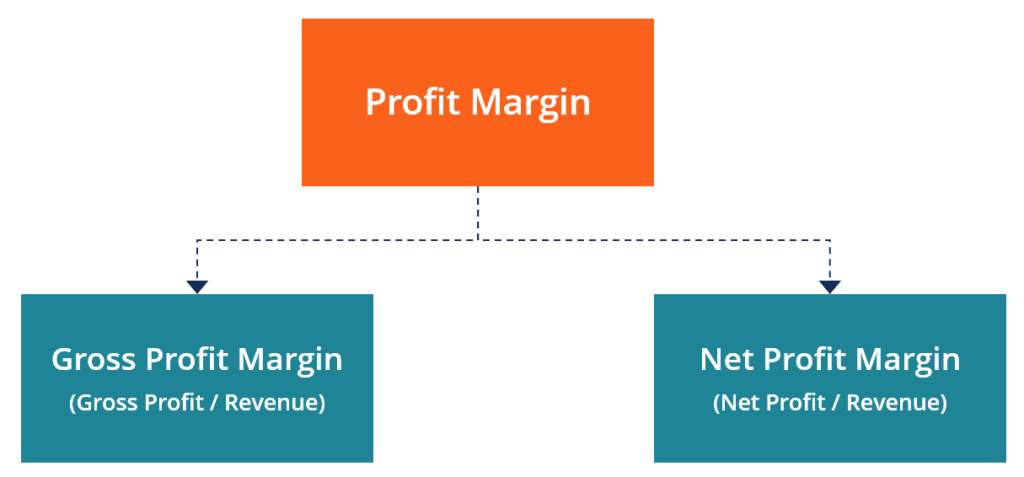

Profit margin is the measure of your business’s profitability. It is expressed as a percentage and measures how much of every dollar in sales or services your company keeps from its earnings. Profit margin represents the company’s net income when it’s divided by the net sales or revenue. Net income – or net profit – is determined by subtracting the company’s expenses from its total revenue.

Calculation of profit margin

Let’s start with your gross profit margin. This is the simplest metric for determining profitability and one of the most widely used financial ratios. Suppose your business makes Rs.100 in revenue, and it costs Rs.10 to make your product. If you make more than one item – or offer more than one service – you can either average the costs of making each product or calculate a separate gross margin for each one.

The cost of making a product is known as the cost of goods sold (COGS). It includes wages and raw materials, but not overhead and taxes. In this example, revenue minus the cost of goods sold would be Rs.100 – Rs.10 = Rs.90. Once you determine your gross profit (Rs.90), divide that number by your revenue (Rs.100): Rs.90 ÷ Rs.100 = 0.9. To get the final percentage, just multiply that number by 100, which makes the profit margin 90% in this case.

Profit margin is important because, simply put, it shows how much of every revenue rupee. It can quickly help determine pricing problems. Further, pricing errors can create cash flow challenges and, therefore, threaten the ongoing existence of your entity.

Different types of profit margin

Gross profit margin

Gross profit margin is the simplest profit margin to calculate. To understand how much of your revenue you have left, use calculations for operating profit margin and net profit margin. The gross profit margin is your overall gross revenue minus the cost of goods. It may not reflect other major expenses.

Operating profit margin

Operating profit margin accounts for operating costs, administrative costs and sales expenses. It includes amortization rates and asset depreciation, but it does not include taxes, debts, and other nonoperational or executive-level costs. It tells you how much of each rupee is left after all the operating costs to run the business are considered. Here is the formula for operating profit margin:

Operating income ÷ Revenue x 100 = Operating profit margin

Net profit margin

Net profit marginis the most difficult type of profit margin to track, but it gives you the most insight into your bottom line. It takes into account all expenses and income from other sources – such as investments. Here is the simplified formula for net profit margin:

Net income ÷ Revenue x 100 = Net profit margin

Your net income can also be defined as your gross revenue minus all of your costs – including COGS, operating expenses, interest and taxes.

Improving profit margins

Your company’s margins reflect the overall profitability of your business, relative to its gross sales. While many companies looking to grow focus their efforts on increasing sales, improving profit margins is another way that business owners can drastically increase their profitability. By widening your profit margins, you can make more from every rupee of your gross revenue.

Tracking expenses

You should always know how much money your business is spending. One of the most important steps in improving your profit margins is tracking expenses. If you don’t know what you’re spending money on, how can you cut costs and ultimately improve your profit margins?

Gross vs. net profit margins

If your gross profit margin and operating profit margin are healthy, but your net profit margin shows issues with the bottom line, you have both non-essential operating costs and overhead you can cut. If the problem shows up at the level of the operating profit margin, your operating costs are more than you can cover at the price you’re charging for your goods or services.

Buy in volume during times when cash flow is less of an issue, and try to stock up during strong seasonal times. Determine what you spend versus what can be cut out; the more detailed you can be, the better.

It is recommended to track specific customer and product profit margins. If you have an unprofitable product or service, you should raise prices, reduce production costs, or discontinue it.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.