Insurance is a means of protection from financial loss. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter

How Does Insurance Work?

As defined above, an insurance policy is a legal contract that binds both policyholder and the insurance company towards each other. It has all the details of the conditions or circumstances under which either the insured individual or policy nominee receives insurance benefits from the insurer.

Insurance is a method by which you can protect yourself and your loved ones from facing a financial crisis. You buy an insurance policy for the same, while the insurance company takes the risk involved and offers insurance coverage at a specific premium.

In case of any eventuality, the insured or nominee can file a claim with the insurer. Based on the evaluation criteria for claims, the insurer reviews the claim application and settles the claim.

Here are some of these components to help you better understand ‘what is insurance’ and how it works:

Insurance Policy Premium

The premium of an insurance policy is the amount that you need to pay to purchase a specific amount of insurance coverage. It is typically expressed as a regular cost, be it monthly, quarterly, half-yearly, or annually, that you incur during the premium payment term.

There are various factors based on which an insurance company calculates the premium of an insurance policy. The idea behind this is to check the eligibility of an insured individual for the specific type of insurance policy that he/she wants to buy.

For example, if you are healthy and do not have a medical history of getting treatment for severe bodily diseases, you will likely pay less for health insurance or a life insurance policy than someone suffering from multiple ailments.

You should also know that different insurance companies may ask for different premiums for similar types of policies. So, selecting the right one at a price you can afford does require some effort.

Policy Limit

It is defined as the maximum amount that an insurance company is liable to pay for the losses covered under the insurance policy. It is determined based on the period (policy term), loss or injury, and similar other factors.

Typically, the higher the policy limit, the higher will be the premium payable. For a life insurance policy, the maximum amount that an insurer pays to the nominee is known as the sum assured.

Deductible

Deductible related to an insurance policy is the amount or percentage that the policyholder agrees to pay out of pocket before the insurer sets in to settle a claim. You can also think of it as a deterrent to small, insignificant claims that many people file under their insurance policies.

Deductibles are applicable per policy or per claim as defined by the terms of a specific type of policy. Generally, insurance policies bought with high deductibles are less expensive as the higher out-of-pocket expense results in fewer claims.

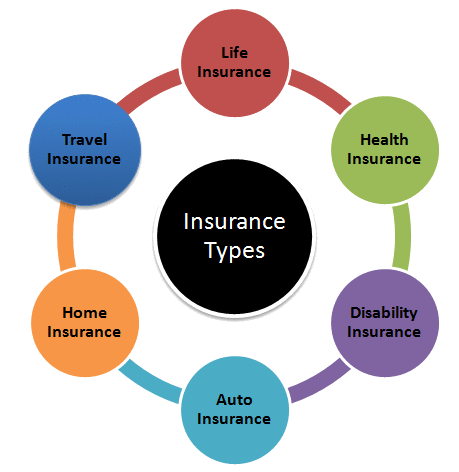

Types of Insurance in India

The four most common types of Insurances that people buy are:

- Life Insurance

- Health Insurance

- Motor Insurance

- Home Insurance

Benefits of Insurance

Insurance policies benefit people as well as society as a whole in various ways. Along with the obvious benefits of insurance, others are not much discussed or talked about.

Cover against Uncertainties

It is one of the most prominent and crucial benefits of insurance. The insured individual or organisations are indemnified under the insurance policies against losses. Buying the right type of insurance policy is indeed, a way to get protection against losses arising from different uncertainties in life.

Cash Flow Management

The uncertainty of paying for the losses incurred out of pocket has a significant impact on cash flow management. However, with an insurance policy by your side, you can tackle this uncertainty with ease. The chosen insurance provider pays in the event of happening of an insured event whenever they occur.

Investment Opportunities

Unit-linked insurance plans, invest a part of the premium into several market-linked funds. This way, they enable you to invest money regularly to benefit from market-linked returns and fulfil your life goals.

Tax Benefits of Insurance

Other than the protection benefits of insurance policies, you can also avail of income tax benefits.

Section 80C

The premium paid to buy life insurance policies are eligible for deduction from the taxable income, Under Section 80C of the Income Tax Act. The upper limit for these deductions is Rs. 1.5 Lakh.

Section 80D

A health insurance premium paid to buy policies for yourself and your parents is also tax-deductible under Section 80D of the income tax Act 1961

Section 10(10D)

The life insurance benefits that you or the insurance policy nominee will receive from the insurer are tax-exempted under this section.

Get an Insurance to Stay Protected

Staying secure with insurance is a necessity in our times. While many invest in different types of insurance, not everyone knows about the many advantages it offers. Insurance, like Life Insurance, secures not only your but also your family’s financial future safely and affordably. Moreover, investing in Life insurance encourages a regular habit of saving money. Thus, it empowers you to build a significant corpus.

Insurance plans such as term plans and health insurance plan from Insurance Companies helps you safeguard yourself and your family’s financial standing and lets you earn multiple other benefits. So, now that you know ‘what is insurance?’, and how it works, you should consider taking the one that suits you and stay secured!

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.