When starting a business, you must answer an important question, How much money do you need? Here’s what you need to know about funding your startup. Starting a business may be an exciting process, but it costs money. When determining business startup costs, it’s important to be realistic. Things like office space, legal fees, payroll, business credit cards, and other organizational expenses can really add up.

Although this is a typical list of business startup costs, your actual startup expenses depend entirely upon your specific business and industry.

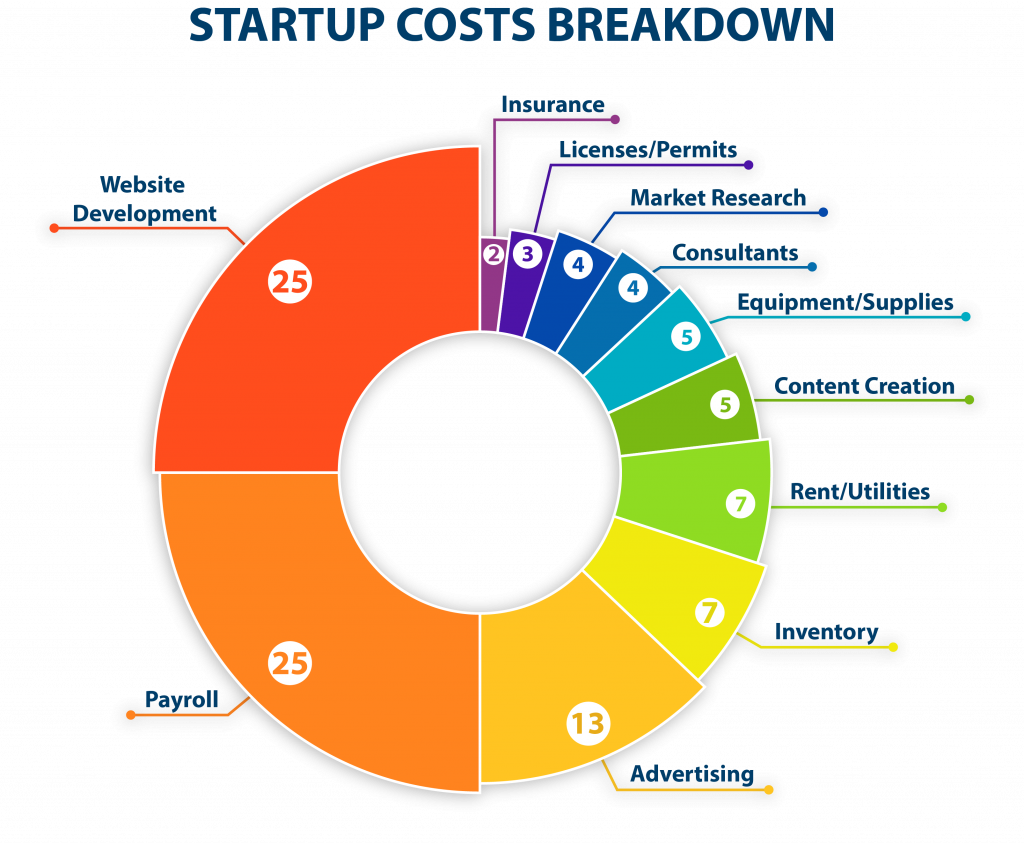

Here are some typical business startup costs to plan for:

1. Equipment

Almost every business will need to finance equipment immediately. Equipment costs for startups can range depending on the industry and size of the company.

Of course, these costs range according to your industry and the size of your business. Hiring employees will incur additional costs, as you may need to secure individual equipment, as well.

2. Incorporation fees

One of your first to-dos when setting up a business is to choose a business entity, which has tax, legal, and financial implications.

If you decide to incorporate your business or form a limited liability company, you’ll need to file articles of incorporation or articles of organization, respectively, with your state.

3. Office space

Renting an office or retail space will be a sizeable portion of your fixed costs, whether you rent or buy. You might spend depending on the type of space you’re using.

You can mitigate these costs if you work from home in the beginning, or look into coworking spaces — both ideal for smaller businesses. And if you own a service-based business, you can travel directly to clients to further decrease overhead costs.

4. Inventory

If you’re in the retail, wholesale, manufacturing, or distribution sector, you’ll likely need to secure inventory to sell, as soon as you possibly can.

Knowing how much inventory to carry can be tricky: If you have too much inventory, you risk spoilage or damage. If you have too little, you risk losing customers who won’t wait for items on backorder. This is especially true for seasonal businesses where inventory can vary drastically year-round.

You should allocate between 17% to 25% of your budget to inventory, depending on your industry. When you’re first starting out, consider securing more inventory.

5. Marketing

Marketing materials might include physical materials, like signs, banners, and business cards. You might also consider paid ads, as well as more creative options, like videos and giveaways, that might require you to hire a consultant or a video producer.

It is recommended to keep overall marketing costs to a minimum. Specifically, strive to keep your ad materials under 10% of your budget.

6. Website

When building your business website, you’ll want it to look professional, be easy to navigate, and display information about your services, products, hours, and contact information.

Fortunately, services like Wix, Squarespace, and Weebly, make creating a website easy and cost-effective. These content management systems are sometimes free, but premium plans will come at a monthly or yearly subscription cost.

7. Office furniture and supplies

Office furniture and supplies add up fast. If you’re operating in a traditional nine-to-five office environment, then every employee will need a desk, a chair, a computer, and a phone. Add in break room appliances, small office supplies, and computer programs, like your accounting software, and you’ll reach a hefty sum. Again, that sum varies depending on the tools your business needs to operate, and the number of employees you need to outfit.

8. Utilities

In addition to the fixed costs of rent and down payment, you’ll be responsible for paying the electric, gas, water, internet, and phone bills for your office space. If you intend to install HVAC units, that will incur an additional cost — usually a couple of thousand dollars, not including installation fees and upkeep.

9. Payroll

You need to pay your employees, even in the early stages, where you’re not bringing in much revenue. Remember, payroll includes all of the following:

- Net pay

- Bonuses

- Commissions

- Overtime pay

- Paid time off

A conservative payroll budget could work if you’re a sole proprietor, or if you’re running a small enterprise

10. Professional consultants

It’s tempting to take a DIY approach for all your business operations. After all, who knows your business best? But working with experts and professionals can be worth the investment.

You don’t need to hire a full-time accountant either. But it’s often a good idea to consult with your accountant on a monthly, quarterly, or annual basis to review your financial statements, and for general financial guidance and advice. Consulting with an attorney regularly can also save you from major legal mistakes like failing to trademark your logo or developing relationships with vendors without a contract in place.

11. Insurance

Your business needs the same protections you provide to your health, home, and car. There are many different kinds of business insurance, including protection from customers that file a lawsuit against you and disaster insurance for potential fires that can shut down your work for weeks.

The type of insurance your startup needs is entirely dependent on your business, industry, number of employees, and other risk factors. For instance, a sole proprietor running an online business has far fewer insurance requirements than a construction company with several employees.

12. Taxes

When planning your budget, determining the exact amount to allocate toward business taxes can be confusing. It depends on your revenue (which is difficult to predict), your deductible expenses, and your business entity.

But know that you can often save money and time by working with a CPA. A skilled CPA will determine what you can deduct so that you pay as little as possible.

13. Travel

Not every new entrepreneur needs to factor travel into their business startup costs. But if you have a consulting business or you visit your customers directly, you will be traveling a lot. You’ll need to factor in the price of transportation, food, and lodging — multiply these costs if you have multiple employees traveling. Be mindful of how quickly those costs add up.

Try to keep total travel costs to an absolute minimum so that you can allocate your revenue toward bigger expenses, like payroll and rent. And to make some returns on all that time on the road or in the air, consider using a travel business credit card, which can earn you points and miles for every dollar you spend. If you do have to travel frequently, keep the nonessentials like business class tickets to a minimum.

14. Shipping

Service-based businesses can probably stop reading here. But if you’re in retail, you might be shipping products to customers. If so, you’ll need to factor shipping into your startup costs, including packing materials and postage. Depending on what you’re sending, these costs can reach thousands of dollars.

Following points are also to be kept in mind:

1. Start small

You most likely have high expectations for your company. However, blind optimism may cause you to invest too much money too quickly. At the very beginning, it’s smart to keep an open mind and prepare for issues that may arise later. business owners should start with a bit of healthy skepticism. A prospective business owner should start planning a small business by simply understanding the potential of the business idea.

The best approach is to test your idea in a small, inexpensive way that gives you a good indication of whether customers need your product and how much they’re willing to pay for it. If the test seems successful, then you can start planning your business based on what you learned.

2. Estimate your costs

Most micro businesses cost around INR 2 lakhs to start, while most home-based franchises cost INR 1.5 lakhs to INR 3 lakhs. While every type of business has its own financing needs, experts have some tips to help you figure out how much cash you’ll require. An estimate is that an entrepreneur will need six months’ worth of fixed costs on hand at startup. Have a plan to cover your expenses in the first month. Identify your customers before you open the door so you can have a way to start covering those expenses.

When planning your costs, don’t underestimate the expenses, and remember that they can rise as the business grows. It’s easy to overlook costs when you’re thinking about the big picture, but you should be more precise when planning for your fixed expenses.

“One of the main reasons most small businesses fail is that they simply run out of cash. Writing a business plan without basing your forecasts on reality often leads to an unfortunate, and often unnecessary, business failure. Without the benefit of experience or actual historical financials, it’s easy to overestimate a new company’s revenue and underestimate costs.

3. Understand what types of costs you’ll have

There are various types of expenses to consider when starting your business. You need to differentiate between these costs to properly manage your business’s cash flow for the short and long term. Here are a few types of costs for new business owners to consider.

One-time vs ongoing costs

One-time expenses will be relevant mostly in the startup process, such as the expenses for incorporating a company. If there’s a month when you must make a one-time equipment purchase, your money going out will likely be greater than the money coming in. This means your cash flow will be disrupted that month, and you will need to make up for it the following month.

Ongoing costs, by contrast, are paid on a regular basis and include expenses such as utilities. These generally do not fluctuate as much from month to month.

Essential vs. optional costs

Essential costs are expenses that are absolutely necessary for the company’s growth and development. Optional purchases should be made only if the budget allows.

Fixed vs. variable costs

Fixed expenses, such as rent, are consistent from month to month, whereas variable expenses depend on the direct sale of products or services. This is a reason that comparing credit card processing providers is so important, processing rates are a variable cost that you’ll want to regularly review to ensure you’re getting the best deal. Shinar noted that fixed costs may eat up a high percentage of revenue in the early days, but as you scale up, their relative burden becomes negligible.

Most common startup expenses

It’s important to understand the different types of costs you’ll have as a new business. Theoretically, it’s good to take note of what costs are fixed, variable, essential, or optional. But let’s get concrete. Here’s a short list of costs you’ll likely have as a new business:

- Web hosting and other website costs

- Rental space for an office

- Office furniture

- Labor

- Basic supplies

- Basic technology

- Insurance, license, or permit fees

- Advertising or promotions

- Business plan costs

Typical costs for startups

The following table estimates very basic fixed costs for a hypothetical startup company with five employees. Variable costs will depend on each business’s situation and are not included in this table.

| Item | Details | Estimated cost in INR |

| Rent | Coworking space membership | 192500 |

| Website | Design and hosting | 140000 |

| Payroll | 5 employees with a $35K/year salary | 12250000 |

| Advertising/promotion | PPC buys in your sector | 350000 |

| Basic office supplies | Paper, pens, etc. | 5600 |

| Total (annualized) | — | 12938100 |

4. Project your cash flow

Another important aspect of a startup’s financial planning is to project the business’s cash flow. New business owners to project their cash flows for at least the first three months of the business’s life. He said to add up not only fixed costs but also the estimated costs of goods and best- and worst-case revenues.

“If you borrow money, make sure you know not only how much you borrowed but also the interest you owe. Calculating these costs puts a floor on the revenues needed to keep the business viable and provides a good picture of the cash necessary to start it up.

This is an essential step in maintaining your business’s financial health. Without being realistic about your cash flow and debt, you won’t be able to get your business off the ground, especially as other costs begin to build.

Starting a business without borrowing at all is better, if possible. Borrowing puts a lot of pressure on any business and its owners, he said, as it leaves less room for error. Do your best to explore all of your funding options. If borrowing is your only option, work closely with your lender to ensure your business is financially able to handle the commitment. Keep in mind that when it comes to small businesses, personal assets are also often on the line.

5. Figure out your financing methods

Once you’ve determined your costs and projected your cash flow, you’ll need to consider how to pursue financing. How you obtain funds will affect the future of your business for years to come. Personal savings, loans from family and friends, government and bank loans, and government grants are just a few potential funding sources.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.