WHY SIZE POSITIONS

WHY SIZE POSITIONS

Going from Rs 1 lakh to Rs 90,000 is easy in markets as its just a 10% fall– but recovering from Rs 90,000 to Rs 1 lakh isn’t – as that implies an 11% jump which most of the time people manage not to somehow get to!

The more the panic, the more likely therefore that the 11% ride back will be difficult as the trader then tries all the tricks in the layman’s book to come back to Rs 1 lakh – taking bigger risks and hoping for bigger gains, till either you suffer a calamitous risk or somehow you just give up blaming equities!

To constantly stay in the game, and to be able to recover requires patience, clarity and one more vital ingredient to our trading strategies – Position sizing!

In simple terms, position sizing is how much you should invest in each stock or strategy. There are therefore different models deployed to reach the optimal position size depending on the objective of the trader.

PURPOSE OF A POSITION SIZING

An Optimal Position sizing has two objectives:

- The main objective is to preserve capital and prevent any catastrophic loss from which one can never recover.

- The second objective of position sizing is to maximise profits without risking defined capital .

If we trade a size that is too big, we are going to break risk. If we trade a size that is too small, we are limiting our potential profits. Thus, one wants to find the sweet spot that maximises profits while ensuring protection of capital.

What we want to achieve with position sizing is easy to understand. Doing it is the difficult part!

THE DIFFERENT MODELS

Simply diversifying the portfolio over n number of companies, and dividing the amount you want to invest by that number and investing the same amount in each company could be one response but this approach has a problem. Since each position has a different risk return profile and correlation with other stocks in the portfolio, eventually you are not just allocating your principal but you are allocating risk between the different positions.

If you invest the same amount in each company you increase the risk in your portfolio towards the most volatile companies. For example, some stocks in your portfolio may move up and down by 0.5% per day while other companies may move up and down by over 5%. This means the profits (or losses) of your portfolio will mainly be dependent on the more volatile companies because they have bigger movements! To give the more stable companies the chance to give you the same amount of profit you should invest a bigger amount in them, and less in the volatile companies. This is called beta sizing or risk parity and there are a lot of ways to do this including plain simple rules that you yourself can define.

In addition, there are different approaches to designing a model and we present below some well known ones:

1. FIXED PERCENTAGE POSITION SIZING MODEL

The idea is to risk a fixed percentage of your trading capital (for e.g. 2%) for each trade. For instance, based on your stop-loss, the largest loss per trade is Rs 5000 out of Rs 2.5 lakhs in your account.

This is a popular position sizing model because it is easy to understand and simple to put in place. However, this requires that the stop losses are put appropriately and not randomly to prevent false whipsaws and killing capital.

2. MAXIMUM DRAW-DOWN POSITION SIZING MODEL

If you have deployed an algo trading model or have a record of your equity curve (this is the NAV of your trading account principal from the beginning), you would see sudden sharp falls in it- when you got certain trades wrong or continuing losses eroded a part of your capital. This maximum fall from the peak to the trough is called a draw-down. Draw-downs ruin trading accounts. Hence, the position sizing model below uses the maximum draw-down to determine how much to risk.

By taking this historical figure as an input, your trade size will be determined to ensure that there is an acceptable loss per trade. By making you visit history, this method ensures you face facts and don’t deploy random trade sizes.

3.THE KELLY CRITERION FOR POSITION SIZING

John Kelly described this criterion more than 60 years ago. The Kelly Criterion computes the optimal size for a series of bets:

Kelly Percentage = W – [(1 – W) / R]

• W – Winning probability

• R – Win/loss ratio

With your trading records, you can calculate your winning probability and win/loss ratio easily. Then, plug them into the equation.

For instance, you win 40% of the time and your win/loss ratio is 2.

Kelly Percentage = 0.4 – [(1 – 0.4) / 2] = 0.1 (10%)

Kelly tells you to limit your position size to 10% of your trading equity for each trade.

DEPLOYING THESE IN REAL SCENARIOS

Using correct position sizing involves three steps:

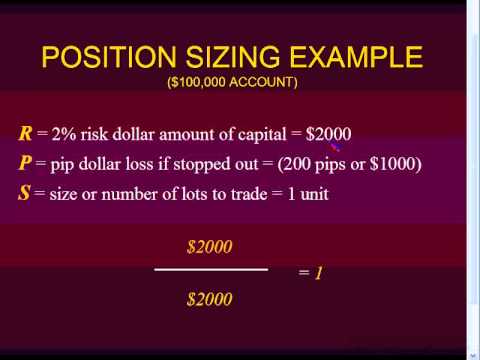

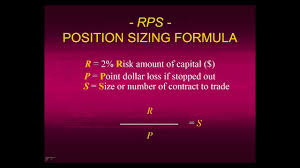

• Determining Account Risk: Before an investor can use appropriate position sizing for a specific trade, he must determine his account risk. This typically gets expressed as a percentage of the investor’s capital. As a rule of thumb, most retail investors risk no more than 2% of their investment capital on any one trade This Even if the investor loses 10 consecutive trades in a row, he has only lost 20% of his investment capital.

• Determining Trade Risk: The investor must then determine where to place his stop-loss order for the specific trade. If the investor is trading stocks, the trade risk is the distance, in % or rupees , between the intended entry price and the stop-loss price.

• Determining Proper Position Size: The investor now knows that he can risk Rs 5000 per trade and is risking Rs 50 per share. To work out the correct position size from this information, the investor simply needs to divide the account risk, which is Rs 5000, by the trade risk, which is Rs 50. This means 25 shares can be bought (Rs 5000 / Rs 50).

POSITION SIZING AND GAP RISK

Investors should be aware that even if they use correct position sizing, they may lose more than their specified account risk limit if a stock gaps below their stop-loss order. If increased volatility is expected, such as before company earnings announcements, investors may want to halve their position size to reduce gap risk.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.