What is Mutual Fund?

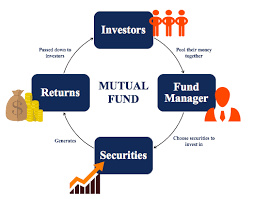

A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets.

Mutual Funds are managed by Asset Management Companies (AMC) which need to be approved by SEBI. A Custodian who is registered with SEBI holds the securities of various schemes of the fund. The trustees of the AMC monitor the performance of the mutual fund and ensure that it works in compliance of SEBI Regulations.

Regulations on Mutual Fund

A sponsor of a mutual fund scheme, a group of the company or an associate which involves asset management company (AMC) of the fund, cannot hold the following in any form:

- 10% or above of the voting rights and shareholding in the AMC or any other mutual fund scheme

- An AMC cannot have representation on the board of any other mutual fund

- Shareholders can’t hold more than 10% of the shares both directly and indirectly in AMC of the Mutual Fund

Types of mutual funds

Mutual funds are categorised and rationalised by SEBI

-

Equity Funds

A Mutual Fund scheme is classified as an Equity Mutual Fund if it invests more than 60% of its total assets in the equity shares of different companies. The balance amount can be invested in money market instruments or debt securities as per the investment objective of the scheme.

| Category Name | Definition |

| Large Cap Fund | An open-ended equity scheme primarily investing in large cap stocks. Minimum 80% total assets are invested in equity & equity related securities of large cap companies |

| Mid Cap Fund | An open-ended equity scheme primarily investing in mid cap stocks. Minimum 65% of total assets are invested in equity & equity related instruments of mid cap companies |

| Small Cap Fund | An open-ended equity scheme primarily investing in small cap stocks. Minimum 65% of total assets are invested in equity & equity related securities of small cap companies |

| Multi Cap Fund | An open-ended equity scheme investing in stocks across market capitalisation (large, small, mid cap). Minimum 65% of total assets are invested in equity and equity related instruments |

| Large & Mid Cap Fund | An open-ended equity scheme investing in stocks from both large cap & mid cap companies. Minimum 35% of total assets are invested in equity of large cap companies and 35% in mid cap companies |

| Dividend Yield Fund | An open-ended equity scheme primarily investing only in corporations that have significantly high dividend yielding stocks. Minimum 65% of total assets invested in equity |

| Value Fund | A Value Fund is a type of Mutual Fund which follows value investing strategy. Minimum 65% of total assets is invested in equity & equity related instruments |

| Contra Fund | A Contra Fund is a type of Mutual Fund which follows contrarian investing strategy. Minimum 65% of total assets is invested in equity & equity related instruments |

| Focused Fund | An open-ended equity scheme investing in maximum 30 stocks from either of the market caps. Minimum 65% of total assets are invested in equity related instruments |

| Sectorial/Thematic fund | An open-ended equity scheme investing in businesses that operates in a particular sector or industry. Minimum 80% of total assets are invested in equity of a particular sector/theme |

| ELSS | An open-ended equity linked tax saving scheme with a lock-in of three years. Minimum 80% of total assets are invested in equity related securities |

-

Debt Funds

Debt funds are mutual funds that invest in fixed income securities like bonds and treasury bills. Gilt fund, monthly income plans (MIPs), short term plans (STPs), liquid funds, and fixed maturity plans (FMPs) are some of the investment options in debt funds.

| Category Name | Definition |

| Overnight Fund | An open ended debt scheme which invests in overnight securities having maturity of 1 day |

| Liquid Fund | An open ended debt scheme which invests in debt & money market instruments with maturity up to 91 days |

| Ultra Short Duration Fund | An open ended debt scheme which primarily invests in debt instruments with Macaulay duration between 3 to 6 months |

| Low Duration Fund | An open ended debt scheme which invests in debt instruments with Macaulay duration between 6 to 12 months |

| Money Market Fund | An open ended debt scheme which invests in debt & money market instruments having maturity up to 1 year |

| Short Duration Fund | An open ended debt scheme which invests in debt instruments with Macaulay duration between 1 to 3 years |

| Medium Duration Fund | An open ended debt scheme which invests in debt instruments with Macaulay duration of 4 to 7 years |

| Long Duration Fund | An open ended debt scheme which invests in debt instruments with Macaulay duration greater than 7 years |

| Dynamic Bond Fund | An open ended debt scheme which invests in debt instruments across durations |

| Corporate Bond Fund | An open ended debt scheme which invests in highest rated corporate bonds. Minimum 65% of total assets are allocated in corporate bonds |

| Credit Risk Fund | An open ended debt scheme which invests in below highest rated corporate bonds. Minimum 65% of total assets are allocated in below highest rated corporate bonds |

| Banking and PSU Fund | An open ended scheme which invests in debt instruments of Banks, Public Sector Undertakings and Public Sector Financial Institutions. Minimum 80% of total assets are allocated in securities from these sectors |

| Gilt Fund | An open ended scheme which invests in government securities across maturity |

| Gilt Fund with 10 year constant duration | An open ended debt scheme investing in government securities having a constant maturity of 10 years |

| Floater Fund | An open ended debt scheme primarily investing in floating rate instruments |

-

Hybrid Schemes

What are hybrid schemes? Hybrid schemes, as their name suggests, invest in a mix of equity and debt. The aggressive ones invest more in equity, whereas the conservative hybrid schemes invest more in debt instruments.

| Category Name | Definition |

| Conservative Hybrid Fund | An open ended hybrid scheme which primarily invests 75% to 90% of total assets in debt instruments and 10% to 25% in equity |

| Balanced Hybrid Fund | An open ended balanced scheme which invests 40% to 60% of total assets in debt instruments and 40% to 60% in equity instruments |

| Aggressive Hybrid Fund | An open ended aggressive scheme which primarily invests 65% to 80% of total assets in equity & equity related instruments. 20% to 30% assets are placed in debt securities |

| Dynamic Asset Allocation or Balanced Advantage Fund | An open ended fund which invests in equity/debt that is managed dynamically |

| Multi Asset Allocation Fund | An open ended scheme investing in different asset classes with a minimum of 10% allocated in each asset class |

| Arbitrage Fund | An open ended scheme investing in arbitrage opportunities with a minimum of 65% of total assets allocated in equity & equity related securities |

| Equity Savings | An open ended scheme investing at least 65% in equity & equity related instruments and at least 10% in debt securities |

-

Solution Oriented Schemes

Solution oriented schemes means focus on a particular solution. They are helpful for those investors who wish to create long-term wealth that mainly includes retirement planning and a child’s future education by investing in Mutual Funds.

| Category Name | Definition |

| Retirement Fund | An open ended retirement solution oriented scheme which comes with a lock-in of 5 years or till retirement age (whichever is earlier) |

| Children’s Fund | An open ended fund for investment for children which comes with a lock-in for minimum 5 years or till the child attains the age of maturity |

-

Other Schemes

| Category Name | Definition |

| Index Funds/ETF | An open ended scheme which replicates/tracks the index. Minimum 95% of securities are invested in the securities of a particular index |

| FoF (Overseas/Domestic) | An open ended fund of fund scheme which invests 95% of the total assets in the underlying fund |

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.