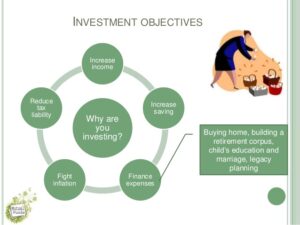

An investment is made because it serves some objective for an investor. Depending on the life stage and risk appetite of the investor, there are three main objectives of investment: safety, growth and income. Every investor invests with a specific objective in mind, and each investment has its own unique set of benefits and risks. Let us understand these objectives in detail.

Safety

While no investment option is completely safe, there are products that are preferred by investors who are risk averse. Some individuals invest with an objective of keeping their money safe, irrespective of the rate of return they receive on their capital. Such near-safe products include fixed deposits, savings accounts, government bonds, etc.

Growth

While safety is an important objective for many investors, a majority of them invest to receive capital gains, which means that they want the invested amount to grow.There are several options in the market that offer this benefit. These include stocks, mutual funds, gold, property, commodities, etc. It is important to note that capital gains attract taxes, the percentage of which varies according to the number of years of investment.

Income

Some individuals invest with the objective of generating a second source of income.Consequently, they invest in products that offer returns regularly like bank fixeddeposits, corporate and government bonds, etc.

Other objectives

While the aforementioned objectives are the most common ones among investors today, some other objectives include:

- Tax exemption

Some people invest their money in various financial products solely for reducing their tax liability. Some products offer tax exemptions while many offer tax benefits on long-term profits. - Liquidity

Many investment options are not liquid. This means they cannot be sold and converted into cash instantly. However, some people prefer investing in options that can be used during emergencies. Such liquid instruments include stock, money market instruments and exchange-traded funds, to name a few.

An investment objective is a client information form used by registered investment advisors (RIAs), Roboadvisors, and other asset managers that helps to determine the optimal portfolio mix for a client. An investment objective may also be filled out by an individual managing their own portfolio.

- What is your estimated annual income and net worth?

- What is your average annual expenses?

- What is your goal for investing this money?

- When would you like to withdraw your money?

- Do you want the money to achieve substantial capital growth or are you more interested in maintaining the principal value?

- What is the maximum decrease in the value of your portfolio that you would be comfortable with?

- What is your level of knowledge with investment products such as stocks, fixed income, mutual funds, derivatives, etc.?

On the other hand, a 40-year-old high-income earner investing to retire in 20 years and who is only interested in preserving capital may construct a long term portfolio with low-risk securities heavily comprised of fixed income, money market, and any investment that would protect his capital against inflation.

- After tax income earned.

- Investment taxes—such as capital gains tax and dividends tax.

- Commissions and fees based on whether the portfolio will be actively or passively managed.

- Portfolio liquidity, which determines the ease of converting securities to cash in case of an emergency.

- Total wealth, which includes assets not included in the portfolio such as Social Security benefits, expected inheritance, and pension value.

An investment objective will typically not be completed by a client until he or she has decided to use the services of the financial planner or adviser since the information that will be provided is highly sensitive. As the client’s goals change over the years due to a major life change such as marriage, retirement, home purchase, change in income, etc., the portfolio manager will re-evaluate the client’s investment objectives and, if necessary, re-balance the investment portfolio accordingly.

Investment Objectives and Robo-Advisors

With the rise of financial technology in the digital era, Robo-advisors are poised to take over the roles of human financial advisors, planners, and money managers. Using a robo-adviser, a client can fill out the investment objective form provided through the robo app or web platform.

Based on the filled out questionnaire, the robo-advisor would recommend an optimal portfolio for the client for a minimal fee, compared to the higher fees charged by traditional advisors. The investment objective form provided by a robo-adviser is much similar to the one provided in the traditional setting. However, the choice of going for either an automated or human adviser is up to a client’s discretion and how comfortable they are with investment products.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.

Definition

Definition