Definition

Definition

A trading plan is a comprehensive decision-making tool for your trading activity. It helps you decide what, when and how much to trade. A trading plan should be your own personal plan. You can use someone else’s plan as an outline but remember that someone else’s attitude towards risk and available capital could be entirely different to yours.

Your trading plan can include anything you would find useful, but it should always cover:

- Your motivation for trading

- The time commitment you want to make

- Your trading goals

- Your attitude to risk

- Your available capital for trading

- Personal risk management rules

- The markets you want to trade

- Your strategies

- Steps for record-keeping

A trading plan is different to a trading strategy, which defines precisely how you should enter and exit trades. An example of a simple trading strategy would be buying bitcoin when it reaches Rs.5000 and selling when it reaches Rs.6000.

A trading plan is a systematic method for identifying and trading securities that take into consideration a number of variables including time, risk and the investor’s objectives. A trading plan outlines how a trader will find and execute trades, including under what conditions they will buy and sell securities, how large of a position they will take, how they will manage positions while in them, what securities can be traded, and other rules for when to trade and when not to.

Most trading experts recommend that no capital is risked until a trading plan is made. A trading plan is a researched and written document that guides a trader’s decisions.

Trading plans can be built in a variety of different ways. Investors will typically customize their own trading plan based on their personal goals and objectives. Trading plans be quite lengthy and detailed, especially for active day traders, such as day traders or swing traders. They can also be very simple, such as for an investor that just wants to make automatic investments each month into the same mutual funds or exchange-traded funds (ETFs) until retirement.

Why a trading plan?

You need a trading plan because it can help you make logical trading decisions and define the parameters of your ideal trade. A good trading plan will help you to avoid making emotional decisions in the heat of the moment. The benefits of a trading plan include:

- Easier trading: all the planning has been done upfront, so you can trade according to your pre-set parameters

- More objective decisions: you already know when you should take profit and cut losses, which means you can take emotions out of your decision-making process

- Better trading discipline: by sticking to your plan with discipline, you could discover why certain trades work and others don’t

- More room for improvement: defining your record-keeping procedure enables you to learn from past trading mistakes and improve your judgment

Automatic Investing and Simple Trading Plans

Brokerage platforms allow investors to customize automated investing at regular intervals. Many investors use automated investing to invest a specific amount of money each month into mutual funds or other assets.

While the process is automated, it should still be based on a plan that is written down. This way the investor is more prepared for what will happen each month, and the planning process will likely also force them to consider what to do if the market doesn’t go their way.

For example, a 30-year-old may decide to deposit Rs. 5000 each month into a mutual fund. After three years, he checks his balance and he has actually lost money. He has deposited Rs.1,80,000 and his holdings are only worth Rs.15,00,00.

The trading plan outlines not only what to do to get into positions, but also states when to get out. Buy and Hold, investors may simply automatically invest and they don’t sell anything until retirement. They may even have a rule of not looking at their holdings.

Other investors may choose to automatically invest only after the stock market has fallen by 10%, 20%, or some other percentage. Then they start to make larger monthly contributions. Or, other investors may choose to automatically invest every month, but have sell rules for if their investments start to decline too much in value.

Automatic investors should also decide how much capital they are going to allocate to each investment. This isn’t a random decision. It should be well-thought-out and researched, then written down in the plan and followed.

While automatic investing is simple, a trading plan is still required to navigate the ups and downs of the investments.

Tactical or Active Trading Plans

Short-term and long-term investors may choose to utilize a tactic trading plan. Unlike automatic investing where the investor buys securities at regular intervals, the tactical trader is typically looking to enter and exit positions at exact price levels, or only when very specific requirements are met. Because of this, tactical trading plans are much more detailed.

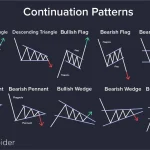

The tactical trader needs to come up with rules for exactly when they will enter a trade. This could be based on a chart pattern, the price reaching a certain level, a technical indicator signal, a statistical bias, or other factors.

The tactical trading plan must also state how to exit positions. This includes exiting with a profit, or how and when to get out with a loss. Tactical traders will often utilize limit orders to take profits and stop orders to exit their losses.

The trading plan also outlines how much capital is risked on each trade, and how position size is determined.

Additional rules may also be added which specify when it is acceptable to trade and when it isn’t. A day trader, for example, may have a rule where they don’t trade if volatility is below a certain level, as there may not be enough movement or opportunity. If volatility is below a certain level, they don’t trade, even if their entry criteria are triggered.

Altering a Trading Plan

Trading plans are meant to be well-thought-out and researched documents, written by the trader or investor, as a roadmap for what they need to do in order to profit from the markets. Plans shouldn’t change every time there is a loss or a rough patch. The research that goes into making the plan should help prepare the trader for the ups and downs of investing and trading.

Trading plans should only be altered if a better way of trading or investing is uncovered. If it turns out a trading plan doesn’t work, it should be scrapped. No trades are placed until a new plan is made.

Example of a Trading Plan

A trading plan can be quite detailed, and at a minimum should outline what, when, and how to buy; when and how to exit positions, both profitable and unprofitable; and it should also cover how risk will be managed. The trader may also include other rules, such as how securities to trade will be found, and when it is or isn’t acceptable to trade.

To give an example of what one of these sections could look like, let’s assume a trader has determined their entry and exit rules. That is, they have determined where they will enter, and where they will take profits and cut losses. Now, they need to come up with risk management rules.

Rules or topics to include in the trading plan may include:

Only Risk 1% of Capital Per Trade

That means the distance between the entry point and stop-loss point, multiplied by the position size, can’t be more than 1% of the account balance. This rule governs position size because position size is the only unknown and needs to be calculated. The trader may opt to risk 2%, 5%, or 1.5%.

Assume a trader has Rs.50,000 in the account. That means he can risk Rs.500 per trade (1% of Rs.50,000). They get a trade signal that says to buy at Rs.35 and place a stop loss at Rs.34. The difference between the entry and stop loss is Rs.1. Divide the total amount they can risk by this difference: Rs.500 / Re.1 = 500 shares. If they buy 500 shares and lose Re.1, they lose Rs.500 which is their maximum risk. Therefore, if they want to risk 1%, they buy 500 shares.

Leverage or No Leverage

The trading plan should outline whether leverage can be used or not, and how much if it is allowed. Leverage increases both returns and losses.

Correlated or Uncorrelated Assets

Part of the risk management process is determining whether correlated assets are allowed to be traded, and to what degree. For example, an investor must decide if they are allowed to take full positions in two stocks that move very similar. Doing so could result in double risk if both hit the stop loss, but also double profits if the targets are reached.

Trading Restrictions

A trading plan may include curbs that stop trading when things aren’t going well. For example, a day trader may have the rule to stop trading if they lose three trades in a row, or lose a set amount of money. They stop trading for the day and can resume the next day. Other trading restrictions may include reducing position size by a set degree when things are not going well, and increasing position size by a set amount when things are going well.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.