All businesses need one government registration or another, while nearly all require multiple registrations. For example, even air-conditioned restaurants need both service tax registration and VAT registration, depending on turnover and location, in addition to a Shops & Establishment License. Indirect taxes are those that are collected from customers by suppliers on behalf of the government. Once these taxes are paid to government, a proper record needs to be submitted periodically.

All businesses need one government registration or another, while nearly all require multiple registrations. For example, even air-conditioned restaurants need both service tax registration and VAT registration, depending on turnover and location, in addition to a Shops & Establishment License. Indirect taxes are those that are collected from customers by suppliers on behalf of the government. Once these taxes are paid to government, a proper record needs to be submitted periodically.

Goods & Service Tax

Goods & Service Tax

WHO NEED TO REGISTER UNDER GST

Annual aggregate turnover from operation is more than Rs. 20 lacs. Annual Turnover over Rs.10 lacs for States- Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand.

GST registration is mandatory in following cases (irrespective of its turnover):

- Currently registered under any of the existing indirect tax regimes (VAT, Excise Laws, Service Tax Laws) irrespective of the threshold limit

- Having multiple business verticals in one state – business units even though registered with the same name and under the same PAN will have to apply for separate registration for each such unit within the same

- Having operations in multiple states- Every person will have to obtain a separate registration for every state in which he has a business establishment whether by same name or a different even if person is having same PAN number and has operations in different states, every operational unit will have to apply for separate registration

- Required to pay tax under Reverse Charge

- Required to deduct tax at source

- Agents of a supplier

- Making any Inter-State taxable supply

- Supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person

- E-commerce Operator / Aggregater who supplies goods or services under his brand name (e.g. Flipkart, Amazon, Ola)

- Supplying goods or services through E-commerce Operator

- Input Service Distributor

- Casual taxable persons

Cases where GST Registration is not required

There are only two cases where GST registration is not required at all even if the turnover is more than 20 lakh. The two cases are as follows:

1. Person supplying exempted goods/services

If a person is engaged exclusively in the business of supplying goods or services or both which is either not liable to tax or is wholly exempt, then he shall not be required to register under GST.

2. An agriculturist to the extent of supply of produce out of cultivation of land

An agriculturist means an individual or a HUF who undertakes cultivation of land by own or by use of labor.

FSSAI Registration / License

The Registration or Licensing of food business operators is governed by Food Safety and Standards Act 2006. FSSAI is under the control of Government of India Ministry of Health and Family Affair. FSSAI sets standards for food products based on science and regulates their production, storage, distribution, sales and imports to ensure they are safe for consumption.

FSSAI license is basically a 14- Digit registration number which is printed on food packages.

Food Safety need

- Food safety means an assurance that the food is acceptable for human consumption according to its intended use

- “Standard”, in relation to any article of food, means the standards notified by the Food Authority

- It is of vital importance to all consumers & food business operators- engaged in production, Processing, distribution & sale

- It provides confidence to consumers that the food they buy and eat will do not harm to them and that they are protected from adulteration/fraud

- Food Business Operator must be registered

- If Food Business Operator is operating in more than 1 state, one additional Central License for Head Office is necessary

- Importers are allowed to take one single central license at their Import Export Code address

- One presumption with various types of businesses is eligible for one registration only

- Food Business Operator must obey the rules and conditions of registration

- Any Food Business Operator without FSSAI food license is liable to pay penalty for the offences

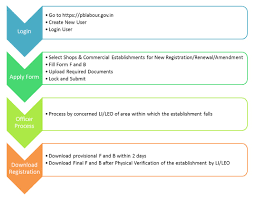

Shop & Establishment

Shop & Establishment

Registration under Shop and Establishment Act (Gumaasta License)

Shops and Establishment Acts have been enacted by the states to regulate conditions of work and to provide for statutory obligations of the employers and rights of the employees in unorganized sector of employment such as shops, commercial establishments, residential hotels, restaurants, eating houses, theaters and other establishments in their jurisdiction.

To regulate conditions of work and employment in shops, commercial establishments, residential hotels, restaurants, eating houses, theaters, other places of public entertainment and other establishment’s. Provisions include Regulation of Establishments, Employment of Children, Young Persons and Women, Leave and Payment of Wages, Health and Safety etc.

Applicability of the Act

- It applies to all local areas specified in Schedule-I.

- Establishment means any establishment to which the Act applies and any other such establishment to which the State Government may extend the provisions of the Act by notification.

- Employee means a person wholly or principally employed whether directly or through any agency, whether for wages or other considerations in connection with any establishment.

- Member of the family of an employer means, the husband, wife, son, daughter, father, mother, brother or sister and is dependent on such employer.

Shop and Establishment Act is one of the most important State Government regulations which governs the functioning of businesses engaged within its Jurisdiction. The Shop and Establishment license is a primary proof of survival of business in a specific jurisdiction.

MSME Registration

MSME Registration

MSME Registration: Udyog Aadhaar Memorandum

- The Ministry of MSME has notified a one page Udyog Aadhar Memorandum (UAM) through a Gazette of India on 18 Sept 2015 as part of initiative to ease of Registration of MSMEs.

- The UAM replaces Entrepreneur Memorandum Part EM I and EM II

- Filing of UAM is optional for MSMEs. It is compulsory for Medium Enterprises

- The units with permanent SSI registration certificates prior to implementation of the MSMED Act, 2006 or EM-II Memorandum or Udyog Aadhaar Memorandum would also be eligible for availing of assistance under various schemes implemented by the Government.

- Unit with EM-II registration are not required to file UAM but if they so desire they may also file the Udyog Aadhaar Memorandum.

- The memorandum shall be filed only after establishing the unit, obtaining all regulatory approvals and starting commercial operations;

- UAM registration has replaced Entrepreneurship Memorandum-If (EM-II) and Small Scale Industry Registration for all purposes. Central or State Government regulatory bodies, tax authorities, utilities providing water, power, etc. banks and other financial institutions and similar organisations should accept UAM in place of EM-II for all purposes. Earlier there was a provision to take Enterprise Memorandum-I (EM-I) registration before setting up an enterprise. Applicants used to file applications for obtaining utilities, building plan approval from local bodies, consent to establish from State Pollution Control Board or applying for term loan from bank or a financial institution to set up the enterprise along with a copy of EM-I.

- UAM registration is given after an enterprise starts commercial operations. Now there is no registration before establishing an enterprise. The practice of EM-I registration is stopped. There is no counterpart document to EM-I.

- Therefore, utilities, local bodies, regulatory bodies, tax authorities, banks and financial institutions and other similar bodies I should not ask for EM-I from the applicants who want to set up an enterprise.

Some of the benefits provided by Central Govt /State Govts who are either registered under EM-II or now under UAM registration may be summarized below

- Government in a phase wise manner enhances the list of reserved products to be brought from MSME’s only and has put in place policies and has reserved three hundred fifty (350) items for purchase from MSMEs, under the Government Stores Purchase Programme.

- To encourage the small-scale units, the SEZs are required to allocate 10% space for the small-scale units

- Under the MSMED Act, protections are offered in relation to timely payment for goods and services by buyers to MSMEs.

- Furthermore, the Government has been encouraging and supporting the sector through policies for preferential access to credit, preferential purchase policy, etc.

- It has been offering packages of schemes and incentives through its specialized institutions in the form of assistance in obtaining finance; help in marketing; technical guidance; training and technology up gradation, Interest concession in Loans ,credit Guarantee scheme for Borrowing from Banks/FI etc.

- As per Trademark Rules 2017, special provision has been carved out for micro and small industries. As per schedule A of the rules, the fees for filing a trademark application for MSME’s is only 50% as compared to another form of business.

- Concessions in Performance credit rating

- Subsidy up to 15% under credit linked capital subsidy scheme (CLCSS)

Importer Exporter Code

Importer Exporter Code

Import Export Code (also known as IEC) is a 10 digit identification number that is issued by the DGFT (Director General of Foreign Trade), Department of Commerce, Government of India. It is also known as Importer Exporter Code.

Importers & Exporters require IE Code

All Importers who import goods into India require an IE Code. The IE Code must be quoted while clearing customs. Also, banks require the importers IE Code while sending money abroad.

All Exporters who export goods or services from India require an IE Code. The IE Code must be quoted while sending shipments. And banks require the exporters IE Code while receiving money from abroad.

IE Code is issued for the lifetime of the entity and requires no renewal. So once a IE Code is obtained, it can be used by that entity for all its import or export transactions without any further hassles.

IE Code does not require the filing of any return. Once, an IE Code is issued there are no further procedures required to maintain validity of the IE Code. Even if import or export transactions occur, there are no filings required to DGFT.

Even individuals who are proprietors of a business can obtain IE Code in their name. It is not necessary to incorporate a business entity for obtaining IE Code.

IE Code can easily be obtained from DGFT within 15-20 working days after submission of the application along with all the necessary information. It is not necessary to show proof of any import or export to obtain IE Code.

Online websites can help your business obtain Import Export Code (IE Code) in 15 to 20 days, subject to Government processing time.

Tax Expert can prepare your IE Code Application in the prescribed format along with the necessary supporting documents and obtain your signature in the application.

Once the application is prepared, you can submit the IE Code Application to the Directorate General of Foreign Trade for further processing and allotment of IE Code.

Once the application and the attached supporting documents are verified, the Directorate General of Foreign Trade will allot a IE Code for your business.

Copyright

Copyright

Indian courts vigorously protect intellectual property rights (IPRs). Following the GATT Agreement India has made its IPR laws TRIPS compliant. Further, we deal with the three major IPR laws viz. Trademarks, Copyrights and Patents.

Copyright is a form of protection provided to the authors of “original works of authorship” including literary, dramatic, musical, artistic, and certain other intellectual works, both published and unpublished. The Copyright Act generally gives the owner of copyright the exclusive right to reproduce the copyrighted work, to prepare derivative works, to distribute copies or phonorecords of the copyrighted work, to perform the copyrighted work publicly, or to display the copyrighted work publicly.

Patent

A patent is a right granted to an individual or enterprise by the government that excludes others from making, using, selling or importing the patented product or process without prior approval. In exchange for this right, the applicant must fully disclose the minutiae of the invention. A patent for a product or process that proves successful can give its owner a serious competitive advantage over rivals. It is valid for 20 years, after which it falls into the public domain. A patentable invention can be any art, process, method or manner of manufacture, machine, apparatus or other articles; substances produced by manufacturing; computer software with technical application to industry or used with hardware; and product patent for food, chemicals, medicines and drugs.

Trademark

Trademark

Trademark (popularly known as brand name) in layman’s language is a visual symbol used by one undertaking on goods or services or other articles of commerce to distinguish it from other similar goods or services originating from a different undertaking. which may be a: Word , Signature, Name, Device, Label, Phonetics Numerals or Combination of colors

The legal requirements to register a trademark under the Act are:

- The selected mark should be capable of being represented graphically (that is in the paper form).

- It should be capable of distinguishing the goods or services of one undertaking from those of others.

- It should be used or proposed to be used mark in relation to goods or services for the purpose of indicating or so as to indicate a connection in the course of trade between the goods or services and some person have the right to use the mark with or without identity of that person.

Under modern business condition a trademark performs four functions:

- It identifies the goods / or services and its origin.

- It guarantees its unchanged quality.

- It advertises the goods/services.

- It creates an image for the goods/ services.

Any person, claiming to be the proprietor of a trademark used or proposed to be used by him, may apply in writing in prescribed manner for registration.

- The application should contain the trademark, the goods/services, name and address of applicant and agent (if any) with power of attorney, the period of use of the mark. The application should be in English or Hindi. It should be filed at the appropriate office.

- The applications can be submitted personally at the Front Office Counter of the respective office or can be sent by post. These can also be filed on line through the e-filing gateway available at the official website.

Types of Trademarks

Any name (including personal or surname of the applicant or predecessor in business or the signature of the person), which is not unusual for trade to adopt as a mark.

- An invented word or any arbitrary dictionary word or words, not being directly descriptive of the character or quality of the goods/service.

- Letters or numerals or any combination thereof.

- The right to proprietorship of a trademark may be acquired by either registration under the Act or by use in relation to particular goods or service.

- Devices, including fancy devices or symbols.

- Monograms.

- Combination of colors or even a single color in combination with a word or device.

- Shape of goods or their packaging.

- Marks constituting a 3- dimensional sign.

- Sound marks when represented in conventional notation or described in words by being graphically represented.

Benefits of registering a Trademark

The Registered Proprietor of a trademark can create establish and protect the goodwill of his products or services, he can stop other traders from unlawfully using his trademark, sue for damages and secure destruction of infringing goods and or labels.

The registration of a trademark confers upon the owner the exclusive right to the use the trademark in relation to the goods or services in respect of which the mark is registered and to indicate so by using the symbol (R), and seek the relief of infringement in appropriate courts in the country. The exclusive right is however subject to any conditions entered on the register such as limitation of area of use etc. Also, where two or more persons have registered identical or nearly similar marks due to special circumstances, such exclusive right does not operate against each other.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.