What is a Market?

What is a Market?

A market is one of the many varieties of systems, institutions, procedures, social relations and infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services in exchange for money from buyers.

A market is a place where two parties can gather to facilitate the exchange of goods and services. The parties involved are usually buyers and sellers. The market may be physical like a retail outlet, where people meet face-to-face, or virtual like an online market, where there is no direct physical contact between buyers and sellers.

The term market also takes on other forms. For instance, it may refer to the place where securities are traded—the securities market. Alternatively, the term may also be used to describe a collection of people who wish to buy a specific product or service such as the Dalal Street or as broad as the global diamond market.

Technically speaking, a market is any place where two or more parties can meet to engage in an economic transaction—even those that don’t involve legal tender. A market transaction may involve goods, services, information, currency, or any combination of these that pass from one party to another.

Markets may be represented by physical locations where transaction are made. These include retail stores and other similar businesses that sell individual items to wholesale markets selling goods to other distributors. Or they may be virtual. Internet-based stores and auction sites such as Amazon and eBay are examples of markets where transactions can take place entirely online and the parties involved never connect physically. The size of a market is determined by the number of buyers and sellers, as well as the amount of money that changes hands each year.

A set up where two or more parties engage in exchange of goods, services and information is called a market. Ideally a market is a place where two or more parties are involved in buying and selling.

The two parties involved in a transaction are called seller and buyer.

The seller sells goods and services to the buyer in exchange of money. There has to be more than one buyer and seller for the market to be competitive.

Monopoly – Monopoly is a condition where there is a single seller and many buyers at the market place. In such a condition, the seller has a monopoly with no competition from others and has complete control over the products and services.

In a monopoly market, the seller decides the price of the product or service and can change it on his own.

Monopsony – A market form where there are many sellers but a single buyer is called monopsony. In such a set up, since there is a single buyer against many sellers; the buyer can exert his control on the sellers. The buyer in such a form has an upper edge over the sellers.

Types of Markets

Types of Markets

Markets vary widely for a number of reasons, including the kinds of products sold, location, duration, size, and constituency of the customer base, size, legality, and many other factors. Aside from the two most common markets—physical and virtual—there are other kinds of markets where parties can gather to execute their transactions.

- Physical Markets – Physical market is a set up where buyers can physically meet the sellers and purchase the desired merchandise from them in exchange of money. Shopping malls, department stores, retail stores are examples of physical markets.

- Non Physical Markets/Virtual markets – In such markets, buyers purchase goods and services through internet. In such a market the buyers and sellers do not meet or interact physically, instead the transaction is done through internet. Examples – Rediff shopping, eBay etc.

- Auction Market – In an auction market the seller sells his goods to one who is the highest bidder.

- Market for Intermediate Goods – Such markets sell raw materials (goods) required for the final production of other goods.

- Black Market – A black market is a setup where illegal goods like drugs and weapons are sold.

- Knowledge Market – Knowledge market is a set up which deals in the exchange of information and knowledge based products.

- Financial Market – Market dealing with the exchange of liquid assets (money) is called a financial market.

Financial markets are of following types:

- Stock Market – A form of market where sellers and buyers exchange shares is called a stock market.

- Bond Market – A market place where buyers and sellers are engaged in the exchange of debt securities, usually in the form of bonds is called a bond market. A bond is a contract signed by both the parties where one party promises to return money with interest at fixed intervals.

- Foreign Exchange Market – In such type of market, parties are involved in trading of currency. In a foreign exchange market (also called currency market), one party exchanges one country’s currency with equivalent quantity of another currency.

- Predictive Markets – Predictive market is a set up where exchange of good or service takes place for future. The buyer benefits when the market goes up and is at a loss when the market crashes.

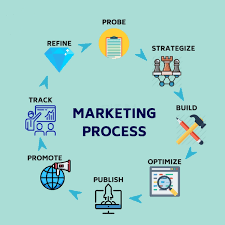

How Markets Work

How Markets Work

Markets are arenas in which buyers and sellers can gather and interact. In general, only two parties are needed to make a trade, at minimum a third party is needed to introduce competition and bring balance to the market. As such, a market in a state of perfect competition, among other things, is necessarily characterized by a high number of active buyers and sellers.

The market establishes the prices for goods and other services. These rates are determined by supply and demand. Supply is created by the sellers, while demand is generated by buyers. Markets try to find some balance in price when supply and demand are themselves in balance. But that balance can in itself be disrupted by factors other than price including incomes, expectations, technology, the cost of production, and the number of buyers and sellers in the market.

Markets may emerge organically or as a means of enabling ownership rights over goods, services, and information. When on a national or other more specific regional level, markets may often be categorized as “developed” markets or “developing” markets, depending on many factors, including income levels and the nation or region’s openness to foreign trade.

Special Considerations: Regulating Markets

Other than black markets, most markets are subject to rules and regulations set by a regional or governing body that determines the market’s nature. This may be the case when the regulation is as wide-reaching and as widely recognized as an international trade agreement, or as local and temporary as a pop-up street market where vendors self-regulate through market forces.

In the United States, the Securities and Exchange Commission (SEC) regulates the stock, bond, and currency markets. Although it may not have full control of the nation’s exchanges, it does have provisions in place to prevent fraud while ensuring traders and investors have the right information to make the most informed decisions possible.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.