Definition

Description

In case of a stop-loss order, the trading company or broker looks at the trading discipline to help the investor cut losses by the current market bid price (i.e. the highest price for the stock at any point of time at which the investor wants to place a bid), and vice-versa, while selling a stock.

For example, if investor ABC wants to place a bid for shares of XYZ company at a certain price point, he/she would instruct his/her brokerage to set the limit against the stock purchase. When the stock reaches the set bid price, an order will be executed automatically to purchase the same.

If you already own the shares of company X and want to sell them, you would ask your broker to sell them when the price reaches at certain high or low. Accordingly, an automatic order will get triggered once the price range matches the set limits.

A stop-loss order is basically a tool used for short-term investment planning. It is used when the investor doesn’t want the pressure of monitoring a security on a day-to-day basis. The trade gets triggered automatically and the limits are decided in advance. This can be very helpful for small investors.

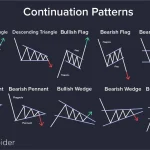

Traders who use technical analysis will place stop orders below major moving averages, trend-lines, swing highs, swing lows or other key support or resistance-levels.

Stop-Loss Orders for Bears

Stop-Loss Orders for Bears

A stop-loss order is essentially an automatic trade order given by an investor to their brokerage to trigger a sale when a certain price level is reached to the downside. The trade (either a market or limit order) then executes once the price of the stock in question falls to that specified stop price. Such orders are designed to limit an investor’s loss on a position. The main risk involved with a stop-loss order is the potential of being stopped out. Stopping out happens when the security unexpectedly hits a stop-loss point, activating the order. The stop could cause a loss on a trade that would have been profitable—or more profitable—had not the sudden stop kicked in. This situation can be particularly galling if prices plunge as they do during a market flash-crash—plummeting but subsequently recovering. No matter how quick the price rebound, once the stop-loss is triggered, it is triggered.

Buy Stop Orders for Bulls

Buy Stop Orders for Bulls

The strategies described above use the buy stop to protect against bullish movement in a security. Another, lesser-known, strategy uses the buy stop to profit from anticipated upward movement in share price. Technical analysis often refer to levels of resistance and support for a stock. The price may go up and down, but it is bracketed at the high end by resistance and by support on the low end. These can also be referred to as a price ceiling and a price floor.

Some investors, however, anticipate that a stock that does eventually climb above the line of resistance, in what is known as a breakout, will continue to climb. A buy stop order can be very useful to profit from this phenomenon. The investor will open a buy stop order just above the line of resistance to capture the profits available once a breakout has occurred. A stop loss order can protect against subsequent decline in share price.

Examples of Stop Orders

For example, if on January 5, 2018, BPL was trading for Rs.175 per share at 1:00 p.m., a market order does not guarantee that an investor’s buy or sell price will be filled at Rs.$175. The investor may get a price lower or higher than Rs.175, depending on the time of fill. In the case of illiquid or extremely volatile securities, placing a market order may result in a fill price that significantly differs from Rs.175.

On the other hand, a limit order fills a buy or sell order at a price (or better) specified by the investor. Using our example of BPL above, if an investor places a Rs.177.50 limit on a sell order, and if the price rises to Rs.177.50 or above, his order will be filled. The limit order, in effect, sets the maximum or minimum at which one is willing to buy or sell a particular stock.

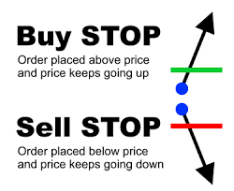

Buy-Stop

A buy stop order is entered at a stop price above the current market price. A sell stop order is entered at a stop price below the current market price. Let’s consider an investor who purchased BPL for Rs.145. The stock is now trading at Rs.175, however, to limit any losses from a plunge in the stock price in the future, the investor places a sell order at a stop price of Rs.160. If an adverse event occurs causing BPL to fall, the investor’s order will be triggered when prices drop to the Rs.160 mark.

Stop Market vs. Stop-Limit

A stop order becomes a market order when it reaches the stop price. This means that the order will not necessarily be filled at the stop price. Since it becomes a market order, the executed price may be worse or better than the stop price. The investor above may have his shares sold for Rs.160, Rs.159.75 or Rs.160.03. Stops are not a 100% guarantee of getting the desired entry/exit points.

This can be a disadvantage since, if a stock gaps down, the trader’s stop order may be triggered (or filled) at a price significantly lower than expected, depending on the rate at which the price is falling, the volatility of the security or how quickly the order can be executed.

For example, assume that BPL is trading at Rs.170.00 and an investor wants to buy the stock once it begins to show some serious upward momentum. The investor has put in a stop-limit order to buy with the stop price at Rs.180.00 and the limit price at Rs.185.00. If the price of BPL moves above the Rs.180.00 stop price, the order is activated and turns into a limit order. As long as the order can be filled under Rs.185.00, which is the limit price, the trade will be filled. If the stock gaps above Rs.185.00, the order will not be filled.

Buy stop-limit orders are placed above the market price at the time of the order, while sell stop-limit orders are placed below the market price.

Stop-Loss

Using this example, one can see how a stop can be used to limit losses and capture profits. The BPL investor, if his order is filled at stop price of Rs.160, still makes a profit from his investment: Rs.160 – Rs.145 = Rs.15 per share. If the price spiraled down past his initial cost price, he will be thankful for the stop.

On the other hand, a stop-loss order could increase the risk of getting out of a position early. For example, let’s assume BPL drops to Rs.160, but goes on an upward trajectory to Rs.185. Because the investor’s order is triggered at the Rs.160 mark, he misses out on additional gains that could have been made without the stop order.

Financial and Business expert having 30+ Years of vast experience in running successful businesses and managing finance.